Shifting to Small Cars?

By the D&S Collective | Spring 1974

The oil shortage has worked wonders for the oil companies’ profits, but not for the auto companies. With many customers scared away from Detroit’s latest gas–guzzlers, GM’s sales for the first ten weeks of 1974 were down 36% from last year; Ford and Chrysler are selling about 20% less than a year ago. At GM alone, 120,000 workers have been laid off or put on “temporary furlough”; the total layoffs in the auto companies and in their dealers and suppliers are probably over 300,000. Auto industry profits, of course, are collapsing, but don’t the major corporations work together in their common interests? If so, why did the oil companies do this to the auto companies?

Read more »

Depreciating the National Pastime

By the D&S Collective | May 1977

Players hailed it as freedom, Oakland A’s owner Charley Finley said it’s “horse manure” and Bowie Kuhn, the Major League Commissioner, euphemistically called it “historic.” At any rate, this year’s introduction of a free agent draft to replace the now-illegal reserve clause (the system that gave each team unlimited rights to sell, trade, or hold onto its players) has meant big changes for baseball. The newspapers are full of sensational stories on multimillion-dollar contracts and the owners continue to insist, as they always have, that freedom in the baseball labor market spells certain doom for the industry. Should we believe these gloomy predictions for our “national pastime”? Read more »

A Funny Thing Happened on the Way to Recession

By the D&S Collective | December 1979

A friend once told us that when he first took economics courses, he thought the constant discussion of “the Fed” referred to people who had enough to eat. He kept waiting to hear about “the Unfed.” If he had been starting economics this semester, he could easily have gone on to conclude that the Fed’s goal is to increase the ranks of the Unfed.

“The Fed” is the oft-used abbreviated name for the Federal Reserve System, which has the job of controlling the nation’s money supply and interest rates. On October 6 [1979], the Fed announced three major changes in its policies, changes which are likely to push the economy into a recession. The Fed’s action is the latest and strongest step in the government’s continuing effort to engineer a downturn.

Read more »

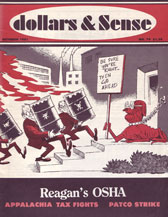

The Economics of the Air Controllers’ Strike

By the D&S Collective | October 1981

The strike and lockout that began August 3 is a result, on the union side, of long-standing frustration with extremely stressful work, combined with a number of strategic mistakes and miscalculations. On the management side, it is a result of union-busting plans endorsed by both the Carter and Reagan Administrations. The significance of the strike goes well beyond the immediate issues of air traffic control; it is an ominous signal that a new era of overtly anti-union politics is beginning in Washington.

Read more »

Can Steel Be Saved?

By Ann Markusen | November 1983

The old–line manufacturing industries will be the last to feel economic recovery. Blue collar unemployment remains high, and Reagan’s economic policies are proving unequal to the task of shoring up basic industry. In this context, demands for an industrial policy—some kind of long–term economic planning—are gaining support from many political directions. One question that any industrial policy would have to answer is: what is to be done with “declining industries”? Should the government preserve and help them, or should the country’s economic resources be allowed to shift to more rapidly growing industries? Read more »

Bucket Brigades & Bailouts

An Inteview with Tom Schlesinger | April 1991

In 1988, several organizations working on banking issues met in Washington, D.C., to discuss developing a common agenda. Out of these discussions rose the Financial Democracy Campaign (FDC), a coalition of groups and individuals organizing a popular response to the S&L bailout and advocating long-term changes in the nation’s financial system. Tom Schlesinger, one of the organizers of the FDC, now serves as its co-coordinator along with Steve Kest, the executive director of the national community group ACORN. Since 1986, Schlesinger has directed the Southern Finance Project, a North Carolina-based research center that works with a wide range of grassroots organizations, unions, journalists, and public officials interested in financial markets and policy issues. Read more »