Clinton's Social Security Scam

This article is from the May/June 1999 issue of Dollars and Sense: The Magazine of Economic Justice available at http://www.dollarsandsense.org

This article is from the May/June 1999 issue of Dollars & Sense magazine.

When President Clinton announced a plan to save Social Security this past January, aides were flummoxed. Many acknowledged that they didn't understand key elements of the plan and were unable to explain it to reporters. The plan is complicated, almost perversely so. It projects large budget surpluses over the next 15 years, $4.5 trillion worth, itself a pretty dubious scenario. Assuming the surpluses materialize, Clinton proposes giving 62% of the money, or $2.8 trillion, to the Social Security Trust Fund.

The twist is that $2.8 trillion is almost exactly the amount of excess payroll taxes slotted for the Social Security Trust Fund in the first place. That's what stumped Clinton's aides. Under Clinton's plan, the SSA will collect excess payroll taxes and give the cash to the Treasury, receiving bonds in return. Normally, Treasury would then spend the funds on education, roads, weapons, and so forth, but Clinton proposes that Treasury instead give the cash back to SSA, who will then give it back once again to the Treasury and receive an additional infusion of bonds. In this way the Trust Fund balance is nearly doubled and Social Security's accounting "crisis" dissolves until 2050 or beyond. Now, if only Treasury and the SSA would make this exchange over and over again, the Trust Fund could be expanded to infinity and the accounting problems of Social Security would disappear forever.

Congressional Republicans fumed at the chicanery of the plan, and it is tricky. Would that Clinton carried the trick just a bit further. After all, the Trust Fund serves no real economic function, save to express, through an elaborate accounting device, a legal obligation of the Treasury to the SSA. If the Treasury were to issue $5 or $6 trillion in special promissory notes today and give them to the SSA, this would have exactly the same effect on the future of Social Security as the Clinton plan. Why, then, collect trillions in excess payroll taxes for 15 years, simply to achieve a paper transaction that Treasury Secretary Robert Rubin could complete in 15 minutes? Clinton's plan exposes the Trust Fund for the accounting charade that it is, so why not go all the way and eliminate the excess payroll tax?

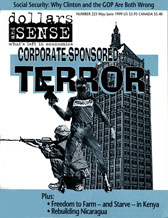

Once Treasury receives the Social Security surplus for the second time, Clinton suggests using the funds to retire part of the federal debt. Republican leadership, shamed by Clinton's cry of "Social Security first," have agreed to support debt retirement. But the federal debt is held by banks, investment firms and wealthy individuals, while nearly all of the projected surplus funds come from low- and middle-income wage earners. Thus do Clinton and the Congress propose transferring income from the poor and middle class to the very rich. In addition to the debt-paydown scheme, Clinton advocates putting another $1.2 trillion of payroll taxes and general revenues toward retirement: $700 billion to be invested by the SSA in the stock market and $500 billion to fund new "individual savings accounts." Altogether, our representatives propose to hand over $3.5 trillion in tax dollars to the finance industry.

Advocates of these "savings" schemes, including many prominent neo-liberal economists, argue that the flood of public funds into financial markets will lower interest rates, stimulate private-sector investment and set off an endless cycle of robust growth. Sound familiar? It should. This is precisely how Ronald Reagan sold his tax cut in 1982. Reagan though, just cut taxes for the rich. It takes Democratic leadership to actually steal our wages and give them to Wall Street.