I Want My Ford Explorer!

But can the world survive cheap gas?

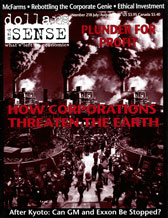

This article is from the July/August 1998 issue of Dollars and Sense: The Magazine of Economic Justice available at http://www.dollarsandsense.org

This article is from the July/August 1998 issue of Dollars & Sense magazine.

Remember the days when we were morally obligated to conserve energy? When it was patriotic to drive a small car and go fewer miles? When you were supposed to turn the lights off when you left a room, keep the temperature down at home in the winter, and weatherize your windows?

Well, you might remember if you’re over 30, or were paying attention during the oil crises of 1973 and 1979. But today all that has disappeared. While recycling is fashionable, and global warming is all the rage, hardly anyone worries about how many miles they drive or how much electricity they use. Everywhere you look, gas-guzzling trucks, vans, and sport utility vehicles are multiplying like rabbits. People move to the farther suburbs to find cheaper housing, better schools, safety, and green space, making non-auto transportation an ever-less-viable option.

Why have we forgotten about conserving energy, and particularly oil? Not because the original reasons have disappeared—in fact our gluttony for oil is a more serious danger than ever. "Project Independence" was supposed to prevent over-reliance on imports, but today more than half of our petroleum comes from abroad. Although fears about running out of gas have receded, some recent projections say that world oil production will begin to decline early in the next century, while global consumption will rise rapidly.

Catalytic converters and unleaded gas have made autos less harmful to the environment than they used to be, but cars and trucks continue to be a major source of air pollution. Most important, the threat of global warming means that, for everyone except oil-industry apologists, slashing our burning of fossil fuels is essential to human survival.

Some analysts have made monetary estimates of the various ways in which we undercount the social costs of oil use. By one calculation, if we included government subsidies, environmental damage, oil-related military expenses, and auto injuries, the real cost of gas in America would be $6 to $12 a gallon!

Despite these facts, what has changed is that actual oil prices, rather than continuing to rise, have fallen dramatically. In the United States, gasoline prices have dropped about 20% since 1978 (adjusted for inflation), while the world price for crude oil has fallen by about one-third. Why worry about oil consumption when, as the cliche goes, a gallon of bottled water costs as much as a gallon of gas, and when gas is only about 11% of the overall cost of driving?

Although future production is likely to decline, crude oil remains inexpensive because of shortsightedness by both the oil companies and producing nations. Western Europe and Japan have counteracted this trend by huge taxes on gas, thereby forcing consumers to conserve. In contrast, both the U.S. government and most environmental groups have concluded that they can’t overcome corporate opposition to price hikes, and consumer aversion to new taxes.

So instead they push high-efficiency and alternative fuel autos as the solution to our gluttony for oil. Yet such a policy is destined to fail. Only a doubling or tripling of energy prices can cause the sharp drop in burning of gas and other fossil fuels that is required to prevent global warming.

Why Are Prices So Low?

Oil is cheap because the world is seemingly awash in it. When prices rose in the 1970s, nations and oil companies went searching for new oil fields (such as in Alaska) and began using expensive technologies to extract greater oil from each field. At the same time, industry converted from oil to alternative fuels in areas such as electricity generation, where coal, natural gas, and nuclear power (which presents its own dangers) picked up the slack. And much conservation did take place, in residences, commercial buildings, industry, and transportation (as the government required cars to get more miles to the gallon).

As a result, production capacity has risen, while consumption has grown only gradually since 1980, and the supply and demand balance has meant falling prices—just as the economics textbooks would predict. The question is whether this trend will continue. Most politicians, consumers, and the oil industry seem to believe the answer is yes, but some experts say that the beginning of the end is near.

"Global production of conventional oil will begin to decline sooner than most people think, probably within ten years," recently argued Colin J. Campbell and Jean H. Laherrère, both respected oil geologists, in Scientific American. "There is only so much crude oil in the world, and the industry has found about 90% of it," say these experts. "The world could thus see radical increases in oil prices," they conclude.

Others disagree, such as the ever-optimistic U.S. Energy Information Administration, which projects that annual oil production will rise by almost two-thirds by the year 2020. If the government is right, then oil could remain abundant indefinitely.

Colin and Laherrère’s forecasts would imply that oil prices should be rising today—if prices were a simple function of the "free market" forces of supply and demand. But besides the uncertainty over future supplies, the oil marketplace’s powerful actors—ranging from Exxon, Shell, and their transnational corporate friends to OPEC (Saudi Arabia, Kuwait, etc.) and the U.S. government—are all trying to affect the price of black gold.

The United States spends a lot of money and effort to give us influence (some would say control) over global oil supplies, particularly those in the Arabian Peninsula. "Desert Storm" in 1990-91 was fought, not to defend freedom and democracy, but to prevent Iraq from gaining control over "our" oil in Kuwait and Saudi Arabia—at a continuing cost of hundreds of thousands of Iraqi lives.

Retired Admiral Eugene Carroll, director of the liberal Center for Defense Information, estimates that the United States devotes upwards of $50 billion a year on military forces dedicated to the Persian Gulf. If this expense was allocated to our oil imports from the Gulf, it would raise the costs from the current $16 a barrel or so to around $90 a barrel!

But these government efforts, and others by the transnational corporations, are designed to buy stability in the flow and pricing of oil, not necessarily to keep prices low. In fact, corporations normally try to raise prices, not keep them low, in order to maximize profits. Moreover, textbook economic theory asserts that if world oil prices are really going to rise in the foreseeable future, as consumption outpaces production, Exxon and friends would be smart to keep more of their oil in the ground today. If they did so, prices would begin rising soon.

Myopic Corporations and Dictators

The same logic holds for Saudi Arabia, Kuwait, and the other oil-producing nations, whether they are members of OPEC or not. But experts say that both the companies and the nations are short-sighted, ignoring profit-maximizing rules that would require them to delay gratification for a decade or more. "Companies and shareholders look at immediate returns, one-quarter out... [They] have long-run strategies, but if they find oil today, they are not going to hold it in the ground because of some analytical view that says in 20 years oil will be $50 per barrel," says Fareed Mohamedi of the Petroleum Finance Company in Washington D.C. Similarly, Lee Schipper of Lawrence Berkeley National Laboratory, one of the nation’s leading authorities on energy use in transportation, says that future scarcity is just not "a relevant issue for financial and political institutions with very short time horizons."

Besides, the companies have limited control over how much oil nationally owned producers decide to pump out each year. OPEC members would prefer, collectively, to act like a good cartel and restrict output in order to raise prices. But as individual, mostly non-democratic regimes they need to sell more oil today in order to spread money around and placate domestic political opposition. Kuwait, for example, "has created comfortable, well-paying jobs for 96% of its working citizens," says Yahya Sadowski of the Brookings Institution. To "prevent a gradual weakening of the economic power of the state and with it the ruling families... [these families] will have to increase oil revenues substantially in a short period," wrote Mohamedi in 1997.

What Difference Would Higher Prices Make?

Even though crude oil is cheap, the United States could, like the other advanced economies, raise prices to consumers through high taxes. But gas prices in America are about one-third those that prevail in Western Europe and Japan. France, for example, taxes gas at $2.84 a gallon, versus an average of 38 cents in the United States.

Perhaps not surprisingly, the United States uses about three times as much energy per person in transportation as do nations such as the United Kingdom, West Germany, and France. Some analysts argue that the difference is due more to factors such as older cities and shorter driving distances in Europe than to higher prices, so that raising gas taxes in the United States would not make that much difference.

But while it is true that auto use, and other energy consumption, seems to grow inexorably due to rising incomes and spreading suburbanization, its rate can be slowed by high prices. For example, average miles driven annually per person in the United Kingdom and France are only 54% and 60%, respectively, of those in America. Lee Schipper says that U.S. tax hikes would take many years to show their full effects, because vehicle fleets change only gradually and buildings even more slowly. But "in the very long run... higher fuel prices [would] arrest our increasing energy intensity."

Schipper has estimated a "price elasticity" for gas of 0.8, meaning that for every 10% rise in prices, consumption would fall by 8% in the long run. If correct, this would mean that government taxes which raised U.S. prices anywhere near European levels (doubling or tripling current prices) would dramatically cut our gas usage—and so allow us to meet the Kyoto global warming goals.

Can We Stop Wasting Gas Without Raising Prices?

Due to Corporate Average Fuel Economy (CAFE) standards, the efficiency of U.S. autos has improved greatly—and both the government and environmental groups hope that CAFE can remain our primary global warming control strategy for transportation. Average miles per gallon (MPG) for new cars rose from 15.3 in 1975 to 24.9 in 1995, getting much closer to foreign levels (such as 25.9 in Japan and 30.8 in West Germany). But most of the change took place by 1980, when MPG had already reached 22.5, and the average has actually been falling since 1991.

How can the United States still be so wasteful of energy if our vehicles are far more efficient than in the past? The answer is that, with cheap gas, we continue to buy more cars and to drive them farther. From 1970 to 1995, annual miles traveled per U.S. vehicle rose 16% to 13,000 a year, leaving us almost 50% higher than the figure for France. During the same years, the total number of cars and trucks on U.S. roads virtually doubled, from 108 to 200 million.

In addition, the loophole for trucks means that all those pickups and sport utility vehicles are covered by a more lenient CAFE standard. With cheap gas, consumers want these gas-guzzlers, and automakers prefer to sell them, since profits are far higher than on small cars. By one estimate, an auto dealer nets about $2,100 profit on a Ford Escort but $8,600 on a Ford Explorer.

In other words, the U.S. government’s strategy, which many U.S. environmental groups have accepted in the face of public opposition to any new taxes, is a failure. "Technology in the real world... is changing too slowly, and lifestyles continue to become more travel intensive," argues Schipper. High gas prices are required to induce the amount of conservation necessary to protect our environment and reduce our need to militarily dominate the Middle East.

Energy Tax Dilemmas

Bill Clinton entered office proposing a "BTU tax," which would have substantially raised prices on all fossil fuels. It quickly fell into political oblivion, a victim of political pressures from the oil companies, automakers, and energy-intensive industries. But also opposed were consumer groups, which have resisted energy taxes since the 1970s.

The latter’s reasons are valid—gasoline, heating oil, natural gas, and electricity are essentials of modern life, and the smaller one’s income the more of it goes into paying for gas and utility bills. So energy taxes, like taxes on any basic consumer goods, are regressive, burdening the poor, working, and middle classes far more than the wealthy (which is why many conservatives are now proposing that a national sales tax replace the income tax).

Of course, the tax money does not disappear, and in theory the government could redistribute the funds back to those who need it—thus discouraging oil use while protecting people’s incomes—as is the case in Europe. But consumer groups justifiably worry that the tax money would not go to low- and moderate-income households, but rather down some rat-hole, such as the military or tax breaks for the rich.

To overcome this objection, several environmental groups, such as the World Resources Institute and Redefining Progress, propose that the government’s bounty from "pollution taxes" be used to slash equally-regressive payroll taxes (for Social Security and Medicare). This would effectively insulate workers; although to protect the poor, senior citizens, and others who depend on government benefits would require also raising benefit levels.

Such a restructuring of the federal tax system makes eminent sense, and could unite labor unions, environmentalists, and consumer advocates. But it is strongly opposed by many corporate interests and by the current congressional majority that is beholden to them—many of whom are still trying to convince U.S. voters that global warming is a figment of our imaginations. At Kyoto, Clinton committed the United States to be an equal participant in preventing catastrophic climate changes. The question remains whether even our fate on earth is enough to overcome corporate dominance.