The Threat from Mergers

Can antitrust make a difference?

This article is from the May/June 1998 issue of Dollars & Sense: The Magazine of Economic Justice available at http://www.dollarsandsense.org

Subscribe Now

at a 30% discount.

This article is from the May/June 1998 issue of Dollars & Sense magazine.

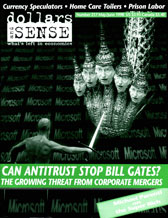

"Are we looking forward to the information age, or will it be the Microsoft Age?," asked Lawrence Ellison, CEO of Oracle Corporation, one of Microsoft's competitors. Hoping to stave off the Microsoft Age, the Antitrust Division of the U.S. Department of Justice has challenged the latest grab for monopoly power by Bill Gates. By doing so, the Division has shown that antitrust is still alive.

Justice sued Microsoft for including a free "Web browser" (used to search for information on the Internet) with all copies of its dominant Windows 95 software— a tactic aimed at excluding Netscape, its main rival, from the browser market. The government went back to court when Microsoft ignored an agreement to stop tying the browser to Windows 95.

This dramatic action notwithstanding, antitrust is sick and has been in retreat for over two decades. The Microsoft action was antitrust's last stand: If the Division had not stood up to Bill Gates in such a high-profile case, with a company using the leverage of an 87% market share to exclude rivals, antitrust would have suffered a fatal blow.

There have been other signs of a mini-revival of antitrust activity in the last year, with the Clinton administration opposing mergers in the retail office supply, retail drug store, and wholesale drug trades, as well as the latest defense industry merger proposal between Lockheed and Northrop. But the administration has allowed, and sometimes facilitated, a vast merger movement transforming many sectors, including banking, hospitals, the media, and telecommunications (see box). Given that such centralization of private economic power threatens both consumer welfare and democracy itself, a more aggressive opposition to mergers should rank high in policy priorities sought by progressives.

Antitrust History

The Sherman Act of 1890 outlawed monopoly and monopolization. It was supplemented in 1914 by the Clayton Act, which made it illegal to have tying agreements, stock acquisitions, and interlocking directorates that would tend to reduce competition. Both acts assumed that high concentration (dominance of an industry by a few firms) would weaken competition and damage the public by reducing output, increasing prices, and slowing technological advance.

This legislation responded to public anger and fears over the ongoing concentration of business, which at the time the Sherman Act was passed assumed the form of "trusts," which brought separate firms under common control. Most notorious were Rockefeller's Standard Oil Trust and James Duke's American Tobacco Company, both of which employed ruthless tactics (local price cutting, denial of pipeline or other distribution access) to acquire large market shares and the power to charge high prices.

But the federal government only minimally enforced the Sherman Act until the election of Theodore Roosevelt in 1900. The Act did not interfere with the great merger movement of 1897-1903, although the Roosevelt administration's successful prosecution of a great railroad merger in the 1904 Northern Securities case may have helped to quiet merger activity. The government successfully prosecuted the Standard Oil and American Tobacco trusts, as the Supreme Court decided in 1911 that both companies were "bad trusts" because of their predatory tactics, and ordered their dismantling. Later, the Court refused in 1920 to condemn the U.S. Steel consolidation, because it was a "good trust" that didn't attack its smaller rivals. This set the stage for a long period when the Antitrust Division and the courts approved mergers that produced industries with a few dominant firms (oligopolies), but which were "well-behaved."

From 1897 onward, moreover, the courts took a harsher stand against price-fixing and market-sharing agreements among rival companies ("loose-knit combinations") than they did against the actual merger of rivals ("close-knit combinations"). This perverse double standard, based heavily on the assumption that mergers advance efficiency, has arguably encouraged mergers.

The effectiveness of antitrust has also been diminished by the cyclical process whereby strongly pro-business administrations (usually Republican) periodically abandon antitrust restraints and permit businesses to restructure and concentrate. The "reform" administrations that follow often restrain or halt but do not reverse these actions. On rare occasion they have unscrambled an especially harmful concentration, such as the public utility holding companies of the 1920s, which were dismantled during the New Deal years.

In the 1920s, the Republicans virtually ended antitrust. In the words of one trade association executive:

Practically, under the Harding, Coolidge, and Hoover administrations industry enjoyed, to all intents and purposes, a moratorium from the Sherman Act, and, through the more or less effective trade associations which were developed in most of our industries, competition was, to a very considerable extent, controlled.

The Golden Age of Antitrust

The Roosevelt administration revived antitrust during 1938 to 1941, and antitrust law had its golden age from 1945 to 1974, fueled by a liberal Supreme Court, anti-merger legislation passed in 1950, and mildly progressive enforcement (though less so in the Republican years). During this period Alcoa (aluminum) was condemned under the Sherman Act and its monopoly was broken (1945), and the Court found the tobacco oligopoly guilty of "group monopoly" (1946), although no effective remedies were put in place (the companies were only assessed a modest fine).

Another danger to consumers is "vertical" monopoly power, which occurs when one company owns two or more stages of the production process (such as raw materials, manufacturing, and distribution). Rival firms may become dependent on buying or selling through the vertically integrated firm, as in the Paramount case (1948), where the linkage between motion picture production and distribution was severed. Tougher standards were imposed on both "horizontal" (within the same industry) and vertical mergers in decisions on Von's Grocery (1966), Brown Shoe (1962), and the Philadelphia National Bank (PNB, 1963). In the PNB case, a merger of banks which together held a 30% market share was condemned by the court as "inherently likely to lessen competition substantially."

Even conglomerate mergers involving unrelated firms were brought under the antitrust orbit in the Procter and Gamble case (1967). P&G was prevented from acquiring Clorox on the grounds that P&G was a potential competitor that could enter the liquid bleach industry by routes other than buying up the leading producer—and thereby eliminating its potential competition.

Sometimes surges of merger activity and concentration have occurred during years of liberal Democratic rule, as with the conglomerate merger movement that took hold during the Johnson years (1964-68), when companies like International Telephone and Telegraph, Ling-Temco-Vought, Gulf & Western, Tenneco, and Litton Industries grew rapidly. Since antitrust law obstructed horizontal and vertical mergers, companies met their powerful drive to grow by acquiring firms in unrelated industries. Such purchases were difficult to attack on grounds of anticompetitive effects. (Eventually, the government did prosecute them on several bases, including the adverse competitive effects and importance of "cross-subsidization"—the ability of a large and powerful firm to subsidize a particular division and overwhelm its smaller rivals.

During the golden age, the courts gave some weight to the social and political value of antitrust action. They recognized the "indirect social or moral effect...[of] a system of small producers," which past decisions on the Sherman Act "prove to have been in fact its purposes," in the words of Judge Learned Hand in the 1945 Alcoa decision. The idea that democracy rests on a system of decentralized power is old and solid, and justifies a strong antitrust policy.

Why Antitrust?

Antitrust action by government assumes that consumer interests are served best when many companies compete to sell each product or service. Monopolies, or tight oligopolies (when a few firms are dominant, and face little threat of entry by new companies), are harmful in several ways. First, lacking the discipline of competition, they have less pressure to minimize costs, and may operate wastefully. Second, they restrict output in order to keep prices and profits high. Third, they may stifle technical progress, because their market power reduces the incentive for both themselves and outsiders to innovate. Finally, huge corporations can exert great political power, thereby undermining democracy.

An important example was the U.S. Steel merger of 1901, which the Supreme Court eventually sanctioned in a 1920 decision. The Court's decision allowed an inefficient and technologically backward firm to dominate a great industry for many decades, entailing heavy social costs. U.S. Steel only became vulnerable when superior, and much smaller, foreign firms were allowed a limited penetration of U.S. markets beginning in the 1960s. Subsequently, the industry's political power allowed it to obtain legislation protecting it from imports. This resulted in high steel prices, burdening numerous steel-using industries and reducing their competitiveness. Ultimately, hundreds of thousands of steelworkers were laid off and local steel-making communities were devastated by the industry's backwardness.

Many other giants of U.S. industry, including American Can, United Shoe Machinery, International Harvester, General Motors, Eastman Kodak, and IBM have demonstrated poor long-term performance. A good argument can be made that their failures were a result of having comfortable monopolistic positions—which more aggressive antitrust action by the government could have challenged.

The Reagan-Bush Collapse

Antitrust enforcement has been cyclical, with Republican presidents slashing enforcement, then Democratic administrations reviving it. Antitrust went into recession around 1974, then plunged in the Reagan era, which was exceptional both for its severe cutbacks of antitrust and for the strong ideological underpinning of this attack. Reagan, and later George Bush, aggressively dismantled antitrust: They imposed drastic (roughly 30%) cuts in budgets and manpower, installed officials hostile to the antitrust mission, and engaged in de facto non-enforcement of the laws (only 16 of over 16,000 pre-merger notifications filed with the Antitrust Division in the years 1981-89 were challenged).

The root of this transformation was the new corporate aggressiveness and campaign to "get government off our backs," which also dates to the early 1970s. This corporate campaign brought Reagan into office and resulted in anti-antitrust actions and rules.

Reagan's antitrust chief William Baxter took the position that mergers were rarely a threat to competition, while "many are in fact procompetitive and benefit consumers." Baxter's positive view of concentration was a precondition for the merger mania of 1981-89. Non-merger related antitrust actions against the Fortune 500 also declined some 90% during this period.

Despite the recent mini-revival, Bill Clinton broke the old cyclical pattern, failing to reverse the collapse of the Reagan-Bush era. Charles Mueller, editor of the Antitrust Law & Economics Review, claims that Clinton has the "sorriest antitrust policy—and appointees—since William McKinley." This may be an exaggeration, but it is true that the Clinton administration has accepted the more limited role for antitrust and the apologetic theories of mergers that came to the fore in the Reagan years. Antitrust budgets have remained below pre-Reagan levels despite new agency responsibilities, and the Federal Trade Commission (FTC) was cut back sharply after 1992.

The antitrust agencies have brought criminal cases for price-fixing and market sharing agreements mainly against small fry industries like fax paper, explosives, and plasterboard. With the exception of Microsoft, and, in early 1998, Lockheed and Northrop, the biggest targets have been Staples and Office Depot, Rite-aid and Revco, and wholesale drug acquisitions by McKesson-Robbins and Cardinal Health.

These are worthy targets, but are of little consequence compared to the giant mergers which the authorities have approved or ignored, and which have been rapidly transforming the financial, industrial, and communication landscapes. During 1997 alone, 156 mergers of $1 billion or more, and merger transactions totalling more than $1 trillion, passed antitrust muster.

Clinton's failure to attack giant mergers rests nominally on the alleged efficiency of large firms and the belief that globalized markets make for competition. FTC head Robert Pitofsky said recently, "this is an astonishing merger wave," but not to worry because these deals "should be judged on a global market scale, not just on national and local markets." "I do not believe that size alone is a basis to challenge a merger transaction," added Pitofsky.

But the efficiency of large size—as opposed to the profit-making advantages that corporations gain from market power and cross-selling (pushing products through other divisions of the same company)—is eminently debatable. And many markets are not global—hospitals, for example, operate in local markets, yet only some 20 of 3,000 hospital mergers have been subjected to antitrust challenge. Even in global markets a few firms are often dominant, and a vast array of linkages such as joint ventures and licensing agreements increasingly mute global competition.

The Clinton administration's failure to contest many giant mergers does not rest only on intellectual arguments. It also reflects political weakness and an unwillingness to oppose powerful people who fund elections and own or dominate the media. This was conspicuously true of the great media combinations— Disney and Cap-Cities/ABC, and Time Warner and Turner—and the merger of Boeing and McDonnell-Douglas, which involved institutions of enormous power, whose mergers the stock market greeted enthusiastically.

The Economists Sell Out

Since the early 1970s, powerful people and corporations have funded not only elections but conservative economists, who are frequently housed in think-tanks such as the American Enterprise, Hoover, and Cato Institutes, and serve as corporate consultants in regulatory and antitrust cases. Most notable in hiring economic consultants have been AT&T and IBM, which together spent hundreds of millions of dollars on their antitrust defenses. AT&T hired some 30 economists from five leading economics departments during the 1970s and early 1980s.

Out of these investments came models and theories downgrading the "populist" idea that numerous sellers and decentralization were important for effective competition (and essential to a democratic society). They claimed instead that the market can do it all, and that regulation and antitrust actions are misconceived. First, theorists showed that efficiency gains from mergers might reduce prices even more than monopoly power would cause them to rise. Economists also stressed "entry," claiming that if mergers did not improve efficiency any price increases would be wiped out eventually by new companies entering the industry. Entry is also the heart of the theory of "contestable markets," developed by economic consultants to AT&T, who argued that the ease of entry in cases where resources (trucks, aircraft) can be shifted quickly at low cost, makes for effective competition.

Then there is the theory of a "market for corporate control," in which mergers allow better managers to displace the less efficient. In this view, poorly managed firms have low stock prices, making them easy to buy. Finally, many economists justified conglomerate mergers on three grounds: that they function as "mini capital markets," with top managers allocating capital between divisions of a single firm so as to maximize efficiency; that they reduce transactions costs; and that they are a means of diversifying risk.

These theories, many coming out of the "Chicago School" (the economics department at the University of Chicago), suffer from over-simplification, a strong infusion of ideology, and lack of empirical support. Mergers often are motivated by factors other than enhancing efficiency—such as the desire for monopoly power, empire building, cutting taxes, improving stock values, and even as a cover for poor management (such as when the badly-run U.S. Steel bought control of Marathon Oil).

Several researchers have questioned the supposed benefits of mergers. In theory, a merger that improves efficiency should increase profits. But one study by Dennis Mueller, and another by F. W. Scherer and David Ravenscraft, showed that mergers more often than not have reduced returns to stockholders. A study by Michael Porter of Harvard University demonstrated that a staggering 74% of the conglomerate acquisitions of the 1960s were eventually sold off (divested)—a good indication that they were never based on improving efficiency. William Shepherd of the University of Massachusetts investigated the "contestable markets" model, finding that it is a hypothetical case with minimal applicability to the real world.

Despite their inadequacies, the new apologetic theories have profoundly affected policy, because they provide an intellectual rationale for the agenda of the powerful. They also gain support because the system is "doing well," at least for a sizable elite. And the increase in global trade and investment gives a surface plausibility to the idea that relaxation of antitrust is both harmless and necessary for "competitiveness."

The Case for Antitrust

Given the weakness of antitrust law—the periodic capture of government by business, gutting of antitrust action, and ensuing burst of concentration—is antitrust not tilting at windmills? In his book Folklore of Capitalism (1937), Thurman Arnold argued that antitrust was a "lightning rod" diverting reformers from serious actions (public ownership, regulation) to calls for enforcing the unenforceable. Antitrust laws were unenforceable, he claimed, because they were attempts to halt the progress of efficiency.

But Arnold greatly overrated the importance of efficiency in explaining merger activity, and he undervalued both the benefits of antitrust and the costs of failing to implement it. Recently, for example, the government's failure to enforce the antitrust laws following airline deregulation in the late 1970s has meant high costs to consumers. A series of mergers has allowed the top four airlines to control 70% of the business at six major hubs, to effectively block entry, and to behave increasingly as a group oligopoly.

"Where Southwest [Airlines, a low-cost outsider] flies, fares are low, but in the rest of the United States, competition ranges from limited to non-existent....The difference between fares in the two markets is astonishing," noted a recent analysis. A one-way economy ticket on Southwest from Seattle to Spokane (223 miles) costs $53. Outside Southwest's territory, a ticket from Detroit to Pittsburgh (198 miles) costs $333.

The social costs of the conglomerate merger movement of the 1960s (a 74% divestment rate) and the junk bond-based merger frenzy of the 1980s were also great. From 1984-88, merger outlays averaged $184 billion a year, whereas corporate investment in new business facilities averaged $84 billion. The money used to buy other companies could have been invested in factory buildings, machinery, and other productive purposes. The supportive environment of a pro-merger antitrust (and tax) policy encouraged such wasteful behavior.

Apart from mergers, antitrust action also yields large benefits in breaking up ordinary restraints of trade—and would accomplish even more with greater resources and political support. Consumers have benefited from breaking up cartels that fix bid prices for government contracts in road building, or in the prices of construction materials, strawberries, and opticians' supplies. In one famous case more than a half century back, an antitrust attack on a cartel selling tungsten carbide caused its price to fall from a range of $225 to $453, to $27 to $45 per pound.

Giant Mergers in the 90s

(billions of dollars)

Defense Industry

- Lockheed-Martin-Marietta, $10

- Lockheed-Loral, $9

- Boeing-McDonnell-Douglas, $13

- Raytheon-Hughes Aerospace, $9.5

- Lockheed-Northrup, $8.2

Telecommunications

- Bell Atlantic-Nynex, $22

- SBC-Pacific Telesis, $16.7

- AT&T-Teleport, $11.3

- Worldcom-MFS, $14.4

- WorldCom-MCI, $36.5

Media

- Westinghouse-CBS, $5.4

- Westinghouse-Infinity Broadcasting, $4.9

- Disney-Cap/Cities, $19

- Time-Warner-Turner, $8.5

Banks (combined assets after merger)

- C&S-Sovran, $49

- NCNB-C&S/Sovran, $118

- Chemical Bank-Manufacturers Hanover, $135

- Bank of America-Security Pacific, $192

- Wells Fargo-First Interstate, $107

- Chemical Bank-Chase Manhattan, $300

Other

- Aetna Life-U.S. Healthcare, $8.9

- James River-Fort Howard (paper), $6.9

- Union Pacific-Southern Pacific, $5.4

- Washington Mutual-H.F. Ahmanson (S&Ls), $9.9

- Compaq Computer-Digital Equip. Corp., $9.6

- USA Waste-Waste Management Inc., $13

Most important and most difficult, however, remains the problem of bringing mergers under control. The ongoing centralization process in the media, and throughout the economy, is incompatible with democracy, and the bias in antitrust policy toward considering only efficiency should be strenuously opposed. Real cost savings from mergers, as opposed to making higher profits through marketing power, are usually small or non-existent in mergers of large firms.

Microsoft, for example, threatens to gain total control over computer software and related information technologies. Its "Windows" software has 86% of all PC operating system sales, and its "Office" suite (word processor, spreadsheet, and database) has 87% of the market for such packages. Moreover, in 1996 and 1997 it bought or invested in 37 other companies. Microsoft has such deep pockets that it can afford to underprice or give away software for as long as it takes to drive a competitor out of the market—a threat now faced by Netscape.

A democratic bias in antitrust policy would incorporate size limits and entirely rule out mergers beyond a certain absolute size and market share. For large firms that do not exceed these limits the acquiring company should have to prove substantial real cost savings to justify any acquisitions.

Thurman Arnold had a point in suggesting the danger of too much reliance on antitrust. It would be a fatal error to allow neoliberals to privatize public agencies and deregulate monopolistic industries, in the hope that antitrust would then make these industries competitive. Privatization is often socially damaging in its own right (see "Privatization: Downsizing Government for Principle and Profit," D&S, March-April 1997), and antitrust certainly does not assure competition.

Deregulated monopolies and oligopolies tend to remain in that condition, and under recent antitrust rules they are not only immune from antitrust attack, but are often permitted to merge with one another (see sidebar, "Antitrust History"). William Shepherd concludes that, since the antitrust agencies "have virtually given up all attempts to treat dominance" under deregulation and privatization, "antitrust is perhaps becoming a haven for dominance rather than a cure for it. Recognizing the danger is a necessary first step toward avoiding a future of monopoly power in telecommunications, railroads and electricity."

The Biggest Merger Yet!

As we went to press, Citicorp and Travelers Group announced their $77.6 billion merger plan. The merger seemed likely to pass muster, despite its great size and conflict with legal restrictions on combining commercial banking with insurance and securities selling (which the companies hope will be removed by legislation or simply evaded). The merger's only touted advantage was its marketing potential, not enhanced economic efficiency. Also going for it was the stock market's enthusiasm and the sheer political-economic muscle of the merging companies. No antitrust obstacle was anticipated.