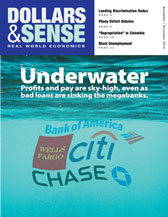

That Hurt! Let’s Do It Again.

This article is from the November/December 2010 issue of Dollars & Sense: Real World Economics, available at http://www.dollarsandsense.org

This article is from the November/December 2010 issue of Dollars & Sense magazine.

Subscribe Now

at a 30% discount.

A Tale of Two Recoveries

It’s official: The Great Recession ended 15 months ago, in June 2009. ... [T]he downturn that began in December 2007 lasted 18 months ... only two months longer than the 16-month downturns of 1973-75 and 1981-82 ... .

What is different about this period is the relative weakness of the economic recovery. ... [I]n 1983 the recovery surpassed its previous peak in gross domestic product very rapidly from the recession’s trough. ...

This time, even after a year of recovery through June 2010, real GDP remained 1.3% below its previous peak ...

Consider this contrast: In 1983, the Reagan cuts in marginal tax rates were finally kicking in, regulatory burdens were falling across the economy, and the Federal Reserve was cutting interest rates. In 2010, taxes are heading up, new regulations are piling up thanks to ObamaCare, et al., and the Fed can’t keep interest rates near-zero forever. We think these different policy circumstances are very much related to the different pace of the two recoveries.

—Wall Street Journal editorial, September 22, 2010

“Slump Over, Pain Persists” read the Wall Street Journal headline the day after the announcement in September that the Great Recession had ended back in June 2009.

The editors’ reaction? Let’s have more tax cuts and deregulation, the very policies that brought on the recession. Their reason? Because the first year of recovery from the 1981-82 recession, following the Reagan tax cuts, was far more robust than the Obama recovery has been so far.

But before you get nostalgic about the Reagan recovery, read the fine print.

To begin with, while the 1981-82 downturn was lengthy and severe, it was no Great Recession. No financial collapse, as even the editors allow, is one profound difference. Others include less drop-off in output, fewer jobs lost, and less long-term unemployment.

Climbing out of a smaller hole than the one left by the Great Recession, the Reagan recovery did manage to post economic growth rates that just matched those of the typical recovery since World War II, something the Obama recovery has not done. But how much of that growth can rightly be attributed to tax cuts?

The answer is, not much. Enacted in 1981, the Reagan tax cuts slashed corporate and individual income tax rates, with the biggest cut in the top rate. “Reaganomics” claimed that drastic tax cuts would restore prosperity by encouraging work, savings, and investment.

But when mainstream economists, such as Barry Bosworth and Gary Burtless of the Brookings Institution, looked closely, they found that something quite different had happened. After the 1981 tax cuts, savings rates actually plummeted. There was no boom in investment, since the tax cuts created large deficits that drove up interest rates, in turn discouraging investment. Men did work somewhat more and married women in particular worked longer hours, yet most saw no increase in their earnings.

What Reagan’s tax cuts and other economic policies did do was to usher in an era of rising inequality. During the 1982-89 expansion, the share of total income gains that went to the richest one percent of households exceeded the share going to the bottom 90% for the first time since the 1920s.

The editors do not cite the next round of pro-rich tax cuts, passed in 2001 and 2003 during the Bush administration. That’s probably because they were nearly devoid of expansionary powers. From 2001 to 2007, the U.S. economy grew more slowly and created fewer jobs than during any expansion since World War II. This was also the only expansion in 60 years that failed to lift real median household income.

If those dismal results are not enough to convince you that more tax cuts are the wrong medicine, consider this. Today, tax rates for the rich—the top income tax bracket, estate taxes, and dividend and capital gains taxes—are lower than they were after the Reagan tax cuts, and would remain so even if the Bush tax cuts for families with incomes over $250,000 were allowed to expire. So much for the economic-growth magic of low tax rates.

It is not taxes or overregulation but poor sales that are the largest single problem facing small businesses, according to the National Federation of Independent Business. But boosting sales remains no mean feat. With persistent high unemployment, wages virtually frozen, and foreclosures continuing unabated, there is no reason to expect consumer spending to rescue the U.S. economy.

Additional government stimulus spending would help, but more than that needs to be done: the deregulatory, inequality-inducing policies initiated during the Reagan recovery need to be undone. And what better place to start than with eliminating the Bush tax cuts for the rich.

Did you find this article useful? Please consider supporting our work by donating or subscribing.