Dear Dr. Dollar:

Bush's budget has the federal government running huge deficits for years to come. Democrats say this will cause high interest rates and low growth. Republicans argue that deficits don't matter at all. Isn't this the exact opposite of what the two parties usually claim? Is my memory shot or am I missing something here?

—Joan Williamson, Sewanee, Tenn.

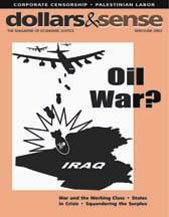

This article is from the May/June 2003 issue of Dollars and Sense: The Magazine of Economic Justice available at http://www.dollarsandsense.org

This article is from the May/June 2003 issue of Dollars & Sense magazine.

Subscribe Now

at a discount.

Welcome to the topsy-turvy world of deficit politics, where nothing is what it seems! Your memory is fine, just too long for a career in politics. Republicans did oppose federal budget deficits as recently as a year or two ago. And once upon a time, Democrats were staunch advocates of Keynesian stimulus policies—running big deficits during a slump to stabilize the economy and promote employment. But Republicans have changed their minds.

When the government spends more than it collects in taxes, it finances the gap by borrowing on the bond market. Government bonds are virtually risk-free. They are as safe as cash but unlike cash, bonds pay interest.

When Bill Clinton was in office, conventional wisdom held that corporate executives loathed deficits because in their view, deficits forced private firms to compete with the government for borrowed funds. Given a choice between risk-free federal bonds and more risky corporate bonds, investors would opt to lend to the government. Economists worried this might drive up interest charges to private borrowers, “crowding them out” of the financial markets and reducing private investment in new facilities and technologies. This is how Federal Reserve chairman Alan Greenspan explained the “facts” of economic life to Clinton in 1992. A chastened Clinton set about putting the government’s books in order.

We now know that life is more complicated. Corporate leaders do indeed detest budget deficits, but only when they are run by Democratic administrations.

Democrats favor policies that redistribute wealth downward—at least some of the time. Clinton, for example, raised the top tax rate on very high incomes from 31% to 39.6%. His administration increased aid to higher education and financial transfers to the working poor. He proposed, but failed to pass, a plan (admittedly badly designed) to provide universal health coverage. Conservatives believe, not without reason, that if Democrats are able to command greater public resources—whether from borrowing or taxing—they will use them to expand public services and social spending. So conservative pundits assailed Clinton for running deficits and, when he closed the deficit, for raising taxes and, when the budget was in surplus, for stealing taxpayers’ hard-earned money.

Republican policies, however, generally redistribute wealth upward. Republicans cut taxes on the wealthy and increase spending on things beneficial to their corporate interests—military hardware, homeland security, agricultural subsidies. Then the Treasury borrows from the wealthy to cover the resulting budgetary shortfall. So the rich receive interest on the loans that cover the debt that their tax breaks and subsidies create.

Congress meanwhile erupts in wrath over “out-of-control entitlements” and proposes “painful but essential” cuts in public services and social insurance programs. In March, the Republican-led House passed Bush’s latest tax cut as part of a budget promising deep cuts in everything but defense and homeland security. The wealthy do not fund candidates promising them tax cuts simply to see their wealth redistributed through the back door via deficit-financed social programs. Cuts in social programs are the whole point.

The problem for conservatives is how to reconcile current budget plans with their erstwhile opposition to deficits. Milton Friedman, guru of free-market economics and an ardent foe of deficit spending, recently laid out the new conservative “theory” of deficits in a Wall Street Journal editorial. “Deficits,” he writes, are probably “the only effective restraint on the spending propensities of the executive branch and the legislature.” Former deficit hawk Rep. Sue Myrick (R-N.C.) concurred, telling the New York Times, “Anything that will help us stop spending money, I’m in favor of. And if there’s a deficit, that may help us.”

So the Republican agenda is to cut taxes and use the resulting deficits to force cuts in spending. What spending? Look at their budget and the party platform: Medicare, Medicaid, Food Stamps and Social Security are all targeted for cuts, privatization or eventual elimination. Of course, if you’re a Republican politician, you can’t stand up in the hometown coffee shop and brag that the deficits you’ve wracked up are actually good because they’re enabling you to cut Medicaid. But neither can you adhere to the Republican tradition of denouncing deficits. So for now, the party line is simply that deficits don’t matter.

As for the Democrats, they made a strategic decision under Clinton to embrace the morality of fiscal discipline. Despite the fact that the typical American household borrows to finance everything from homes to cars to college to washing machines, ancient moral enjoinders against borrowing weigh heavily on the popular conscience. Republicans in the past proved adept at tapping into these moral anxieties. The Democratic leadership is apparently employing this tactic now to fight Bush’s tax cuts.

Such is the sorry state of U.S. political discourse that the really important questions—what the government does with its resources and who, ultimately, foots the bill—have become mired in these exasperating and exhausting debates about deficits.

Did you find this article useful? Please consider supporting our work by donating or subscribing.