A Little Better Now—But What about the Future?

The Jobs Report from the National Jobs for All Network

To understand the decline of product quality at the aerospace firm, listen to whistleblowers and watch management’s bizarre behavior.

Astronauts Suni Williams and Butch Wilmore are not trapped in space, according to Boeing. The two expected to return to Earth from an eight-day mission on June 18. However, five out of the 28 thrusters on their Boeing Starliner spacecraft failed when the spacecraft docked at the International Space Station on arrival. Does the spacecraft have enough thrusters to return to Earth? The return initially forecast for June was postponed until July, and as of September 1, the two have been there for 87 days. The earliest Williams and Wilmore are now expected to return to Earth is February 2025. In the year 2000, Boeing epitomized gravity-defying technology that put safety first. By 2024, Boeing has lost credibility, which is why we do worry for the two astronauts.

In January 2024, on Alaska Airlines Flight 1282, a door plug blew off a Boeing 737-9 Max because none of the four bolts were there to attach it to the plane. Passenger Cuon Tran explained, “This hole just opened up on the side panel, and the next thing you know, my whole body lifted up.” Tran credits his seatbelt with saving his life. The incident was eerily similar to a 2017 incident when a part flew out of a Boeing 737 engine and broke the window next to Jennifer Riordan’s seat, causing her death. Wheels and engines falling off planes and smoke pouring into the passenger cabin are other recent Boeing mishaps that might have come across as absurd, were they not actual threats to the lives of passengers and crew. These brushes with disaster are in addition to incidents in 2018 and then again in early 2019 in which the flight-control program built into the piloting system took over the controls of two Boeing planes and forced their noses down into the Earth, killing 346 passengers. The narrative put out by the company in 2019 was that the two crashes were caused by a software bug that could be fixed.

Forced overtime and excessive outsourcing were the real causes of the faulty planes, according to Ed Pierson, a former manager of the plant in Renton, Wash., that produced the 737 Max 8s that self-programmed to crash. (The 737 Max 8, like the 737-9 Max, are two of several plane models currently in service from Boeing’s 737 series of airplanes, which first launched in 1968.) The planes’ flight-control program pushed the nose down because each received faulty data from a sensor on the wing indicating that the plane was going nose up when it was not. Pierson asked how new sensors on two brand-new planes could fail. His prime suspect was the exhaustion of the men and women installing the wiring in awkward positions, coupled with the ill-timed arrival of the parts needed to complete the planes. As one Boeing employee posted anonymously on Reddit: “Overtime should be voluntary ... I spent many, many years being designated and having plans messed up by being volun-told to be at work … People being forced to work do not perform at a high caliber and it just overall kills morale.”

Furthermore, Boeing had paid high-wage workers in Italy to design fuselages, and others in Japan to design wings, leading to a reduction of quality control at the innovation stage. The fuselages and wings were then manufactured in Wichita and delivered by rail to Puget Sound, making for dramatic shipping issues in Boeing’s supply chain. In 2018, partially finished planes were piling up outside the Renton plant, occupying employee parking lots, as each waited for missing parts. Pierson had gone two levels up in the workplace hierarchy to ask, six months prior to the first crash in 2018, that the production line be shut down because the process had lost integrity. Overtime for six weeks and chaotic supply issues led to an exhausted workforce, with predictable slipups. When management ignored his pleas, Pierson, once a Navy man, became something he never expected to be: a whistleblower testifying before Congress to get the Federal Aviation Administration (FAA) to intervene at Boeing.

The declining quality of Boeing planes is indicative of the haphazard conditions in which Boeing engineers, machinists, and quality-control inspectors work, and these production conditions are behind the egregious failures of Boeing planes. Pierson was just one of many Boeing staff to put their careers on the line to sound the alarm. But what are the deeper causes of Boeing’s crackup? Boeing is like a canary in the coal mine, warning us that permitting executives and institutional investors to siphon money out of production leads not only to hardship for the company’s workforce, but also to a decline in product quality that is dangerous to the customer.

Collectively voicing workplace concerns as a union member is much easier on a human being than speaking out as an isolated individual. Let us consider the systematic methods that Boeing management used between 2008 and 2024 to suppress union’s expression of discontent, such that many concerned employees felt the only option was to become whistleblowers. In 2008, after a 58-day strike against Boeing, the locals of the International Association of Machinists (IAM), District 751 (Puget Sound, Wash.) and District 63 (Gresham, Ore.), gave up their defined-benefit pension plans, accepted 1% raises, and accepted a two-tiered wage system (in which new hires start at and max out at lower salaries than those hired earlier). At enormous cost, Washington State’s Boeing management created a second manufacturing line, in addition to their factory in Everett, Wash. (one of the main cities in the Puget Sound region), to build 787 Dreamliners in North Charleston, S.C. Boeing then credibly threatened to move production from Washington State’s experienced machinist workforce to the inexperienced, nonunionized workforce at Charleston in 2011. The threat succeeded in getting the IAM local in Puget Sound to accept a three-year extension of the same lousy contract from 2008 (plus higher health care costs) in return for keeping production of the 737 Max in Washington State. In 2013, Boeing further threatened workers, this time with moving production of its 777 aircraft from Everett, Wash., to South Carolina if the IAM did not accept another contract extension. Despite the threat, the members of District 751 in Puget Sound voted against the extension. At this point, the national president of the IAM, Thomas Buffenbarger, tricked the machinists into voting for a contract extension by holding a second vote on January 3, 2014, when many workers were away because the plant was on holiday shutdown. Boeing CEO Jim McNerney was richly rewarded for undermining the quality of life of the workers in Washington State and received $29 million in total compensation (which included his salary, bonuses, and stocks) in 2014.

This crushing union defeat in 2014 may explain the growing number of whistleblowers as the last line of defense for employees to enforce safety standards at Boeing. As part of a shareholder lawsuit against Spirit AeroSystems alleging flawed manufacturing of 737 parts, Joshua Dean, a quality inspector in Wichita, Kan., said in his December 2023 testimony that he’d told his coworkers that “it was just a matter of time until a major defect escaped to a customer.” Given the number of fuselages and wings leaving Wichita with serious flaws, with these words Dean predicted that quality inspectors would not catch every problem before airlines would purchase the planes and put them in the air. One month later, the door came off a Boeing 737 while it was in flight.

Dean worked officially at Spirit AeroSystems, but the plant in Wichita was historically owned by Boeing. When the private-equity firm Onex bought Spirit in 2005, it made the long-time Boeing workers reapply for their jobs and did not rehire many over the age of 50; for those rehired, the pay was 10% lower. The sale of the plants in Kansas looked like a maneuver to shed experienced and highly paid workers and replace them with inexperienced, lower paid people. Onex made a 900% return on its investment by the time it sold Spirit in 2014, but product quality at Spirit AeroSystems had been compromised, as Dean had testified.

The Wichita plant supplied Boeing with fuselages and wings for the 737 line of planes. Many Boeing workers displayed the courage and integrity that inspired Dean, Pierson, and others to fight on the job for the right to produce a quality product, and then to turn to the lonely path of becoming whistleblowers. Whistleblowers’ efforts meant they often faced retaliation from managers who wanted to produce planes without making sure they would be safe for the up to three decades’ worth of flights that the planes would fly. As anyone who has worked with a supervisor who wants to undermine them knows, clocking into a hostile work environment every day wears a human being down. For example, engineer Martin Bickeböller filed alerts in 2014 and 2021 that the quality oversight process on the Dreamliner was systemically flawed, and in 2024 he filed alerts again on the grounds that Boeing management had retaliated against him for his previous concerns. Boeing’s subcontractor, Spirit AeroSystems in Wichita, fired Dean in April 2023 for his involvement in a shareholder lawsuit, and he then died suddenly of an infection in April 2024. Renton 737 quality inspector Sam Mohawk was ordered in 2023 to hide the existence of defective parts from FAA regulators. On April 17, 2024, engineer Sam Salehpour of the Everett, Wash., plant testified that sections of the 1,000 Dreamliner plastic composite fuselages were attached to each other in a faulty manner, which meant that “they could ultimately cause a premature fatigue failure without any warning,” the implication being that the planes could come apart in midair.

In 2010, John Barnett, a quality control inspector at the Everett, Wash., factory where 787 Dreamliner planes were built, transferred to South Carolina, where he was tasked with maintaining quality standards at the new, nonunion plant where Dreamliners were also built. In March 2024, Barnett testified to Congress that

[I]t was a brand-new site, brand-new employees. I was responsible to figure out the type of training we would need to provide our inspectors…for making sure the product met Boeing specifications and requirements and FAA requirements. If I had an employee who wasn’t performing, it was my responsibility to take appropriate corrective action.

Barnett, who worked at Boeing for over 30 years, filed a whistleblower complaint in 2017 with the Occupational Health and Safety Administration (OSHA), as well as a formal complaint with the FAA and other regulatory bodies, in an attempt to protect the flying public. By 2024, when he testified for his case alleging that Boeing retaliated against him for filing the complaints, he said that Boeing put him in a position “where I either had to do as I’m told and violate the law, or not do as I’m told and be insubordinate,” which he described as a “very tough spot to be in.” When he kept pushing back against management’s unwillingness to follow safety procedures, Barnett said it was clear that “they pretty much wanted me out.”

After reliving the experience through two days of testimony, Barnett was found dead on March 9, 2024, in his car. The police ruled the death a suicide.

Collective action, thankfully, is returning. On July 17, 2024, 20,000 Boeing machinists gathered at a baseball stadium in Washington State to vote 99% in favor of striking, should their demands not be met by September 12, when their existing (and lousy) contract expires. An end to mandatory overtime, a 40% pay increase to exceed the 30% inflation over the past 15 years—and restoration of the pensions that the machinists lost 16 years ago—these are what the machinists want. The 23,000-strong union of Boeing engineers, the Society of Professional Engineering Employees in Aerospace (SPEEA), stands behind them, and any passenger should hope the machinists win. “Make sure they get a good deal. Make sure you recognize the criticality of what they do,” stated none other than Tim Clark, head of Emirates airline, which has purchased more Boeing 777 aircraft than any other airline in the world.

Most readers probably agree that Boeing management was responsible for eroding the quality of their employees’ professional lives, but this story also brings to light the extent to which managing a company with the goal of minimizing investment in production can be entirely at odds with creating a quality product. The conditions under which quality inspectors, machinists, engineers, and computer scientists operate directly affect the quality of the planes—in the same way that the quality of patients’ medical care depends on the conditions under which nurses and doctors work, or that the quality of students’ education depends on the support and respect that their teachers receive. It’s not news that workers in the United States have experienced a steady decline in pay relative to executives—but the Boeing debacle makes us face up to the fact that abusing the workforce leads to a deterioration in the quality and safety of products.

The main contribution of my 2021 Dollars & Sense article on all this (“Boeing Hijacked by Shareholders and Executives!,” July/August 2021) was to confirm from publicly available annual reports that most of Boeing’s free cash flow went into stock buybacks which enriched executives and institutional shareholders directly, while reducing the money available to invest into capital equipment to make airplanes (see Figure 1). Capital invested back into making airplanes dropped from 65% of free cash flow in 1990, to a mere 6% in 2018.

After the computer program crashed two Boeing planes in 2018 and 2019, the old CEO Dennis Muilenburg was out, and in came Dave Calhoun, who ran the company from 2020 to 2024. These were challenging years given that the FAA grounded the 737 Max planes for 20 months (from March 2019 to December 2020), which halted deliveries to customers, and then the Covid-19 pandemic in 2020 caused a cessation in travel, and as a result airlines experienced losses, which rippled through to Boeing as a manufacturer of airplanes.

In a dramatic change from his predecessor, Calhoun issued no stock buybacks during his four-year tenure from 2020–2024. One might assume that giving up buybacks would lead Calhoun to invest more in production—but this was not to be.

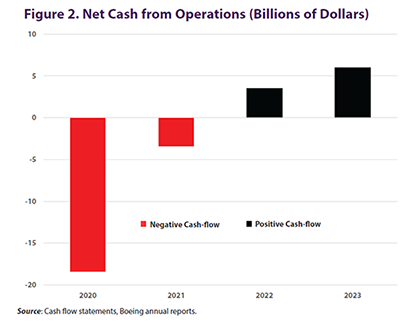

Calhoun was not an engineer, but rather a financier. His previous job, with the Blackstone Group, involved comparing returns at different companies which the firm’s private equity arm had purchased through leveraged buyouts. This suggests that Calhoun’s expertise was debt. Boeing’s board probably selected Calhoun to improve cash flow, despite the money-losing plane business. As Figure 2 shows, the company was either operating at a loss (2020–2021) or making negligible profits (2022–2023).

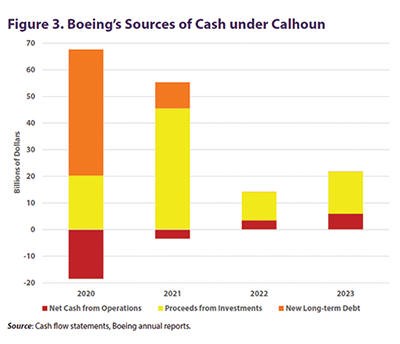

Figure 3 shows the three ways that Boeing raised virtually all of its cash under Calhoun: new loans, successful bets in financial markets, and sales of planes (operations). In 2020, the firm borrowed massively (orange). From 2021–2024 cash from selling off investments in financial markets (yellow) was a much greater source of cash for Boeing than either selling planes (red) or taking on new debt (orange). In effect, in 2020 the CEO used the value of Boeing as collateral for taking out a very large loan.

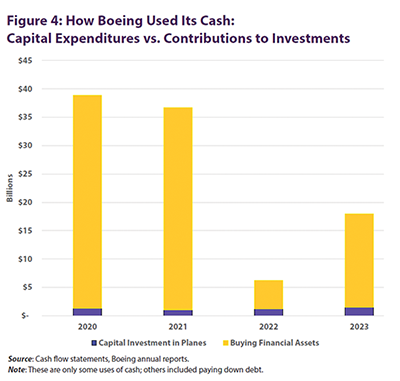

Let’s pause here to consider how odd it is that in 2023 Boeing’s primary source of funds was not selling planes, but rather financial market winnings! In Figure 3, the yellow bar for 2023 represents $15.7 billion from cashing out investments, while that year the firm made only $5.9 billion from selling planes. Under Calhoun, Boeing was becoming a company that gambled on Wall Street in order to generate revenues, more than a company that manufactured planes. The firm spent only 2% to 3% of its free cash on capital investment, even less than it had under Muilenburg (6%), and far below the 65% on capital expenditures incurred back in 1990. Figure 4 illustrates how much higher short-term bets on financial assets were compared to long-term bets on accumulating capital for planes.

The financialization of the modern U.S. corporation is evident in Figure 4, which shows how Calhoun used the large loan of 2020 and any other funds he obtained during his tenure. In 2020, Calhoun borrowed $47 billion in Boeing’s name, and then invested only about $10 billion of that money into making planes, instead using $37 billion of the borrowed funds to purchase something in the financial markets. What did Calhoun buy? The annual reports tell us only that the $37 billion was invested in “debt instruments,” i.e., Boeing borrowed money to lend to other corporations by buying corporate bonds in financial markets. Whatever Calhoun purchased with the $37 billion, it does not appear that the transaction was in Boeing’s best interest, because the company lost money on Calhoun’s financial transaction: Boeing’s balance sheet indicates that the firm earned about $500 million on the $37 billion invested in financial markets, but paid $2 billion in interest to borrow the initial $47 billion. Money invested in equipment to build actual planes (capital expenditures) in 2020 was only 3% of free cash flow. Today, in 2024, Boeing is saddled with some $50 billion in debt—largely because of Calhoun’s 2020 borrowing spree—while its primary competitor, Airbus, has $9 billion in reserves. By the way, in 2020, the U.S. government probably would have given Boeing money as it gave it to many U.S. corporations during that pandemic year. Calhoun declined the government handout, perhaps because he feared the quid pro quo would be limits on executive pay and his decision-making authority, two limits which might well have benefited most of the company’s stakeholders.

Operational failures require operational solutions—and yet Boeing in 2020 did not hire an engineer, but rather a financier. Perhaps the Boeing board believed its own public-relations messaging that the 2018 and 2019 crashes were due to a simple computer bug that could be fixed, despite many employees coming forward at great personal cost to identify demoralization, forced overtime, lack of training, and the harassment of engineers and quality inspectors who tried to uphold quality standards as the reason why the planes fell from the sky.

On July 9, 2024, Boeing agreed to plead guilty to fraud concerning the quality of the 737 Max planes in its dealings with the FAA, and Calhoun ended his tenure as CEO. On August 8, 2024, Boeing hired Kelly Ortberg as the new CEO, and there was reason to breathe a sigh of relief. Ortberg is an engineer with a background in aerospace manufacturing. Even more reassuring, he announced that his office would be in Washington State, and he has already walked onto the shop floors at the Everett and Renton plants. Ortberg is clearly an operations specialist, which is reason for optimism, but changing the CEO does not address the systemic issues that lie behind such a major pillar of U.S. manufacturing capacity losing its integrity.

Boeing would need to increase capital expenditures from $1.5 billion per year to something on the order of $35 billion per year to return to the 1990 level of spending 65% of free cash flow on capital accumulation. Boeing is currently operating at a loss and has around $50 billion in debt. Restoring integrity to production will involve hiring quality inspectors, mechanics, and machinists so that overtime in manufacturing can end, and the workforce also deserves a raise and better benefits.

The back story of Boeing’s Kafkaesque management decisions is a fundamental imbalance in the U.S. economy: The risk-adjusted return for tying up capital in airplane manufacturing appears to be lower than the return on more liquid, safer investments. Indeed, the mere possibility of future profits routinely gives substantial market valuations to firms like Boeing that produce at a loss. This imbalance means that when guided by the imperative of maximizing shareholder value, corporate leadership will tend to invest less and less into manufacturing and more and more into increasingly speculative bets with potential immediate payoff. The fact that the company’s long-term prognosis is now grim may perversely increase the incentive for executives and institutional investors to cash out while they can. Be that as it may, this fundamental imbalance between reward for long-term and short-term investment may explain why Boeing reduced capital expenditures from 65% of free cash flow in 1990 to a mere 2% by 2021. In the first decade of the new millennium, “asset light” became the watchword, with firms aiming to sell off their capital investments (as when Boeing sold the Wichita plant to Onex) so that they could access speedier ways of turning money into more money than manufacturing, such as manipulating their own share price, political contributions, or buying corporate bonds. The 2001–2010 period is when Boeing outsourced innovation in fuselages to Italy and wings to Japan. By outsourcing innovation, the firm freed up funds to buy back its own shares of stock, which was the particular bet that executives at the firm had identified as winnable. Executives were incentivized to aim for a high share price because their compensation was tied to that metric—and, sadly, it still is. Ortberg receives $1.5 million in base pay, which pales in comparison to the $3 million bonus and $17.5 million in stock awards that he will receive if he can achieve “targets”—usually code for making the stock price rise to a certain level. So long as the stock price is the CEO’s beacon, institutional investors will hold influence over his decisions. As Boeing’s top three institutional investors, Vanguard owns 8% of Boeing, BlackRock owns 6%, and Newport Trust owns 5%. A decision by the manager of the Boeing account at any one of these three investment companies to sell or buy Boeing stock would so affect the share price that this person, most likely, can get the CEO of Boeing on the phone. The top priority of institutional investors is to get the share price to rise to placate their own investors.

Boeing is too big to fail. Airbus, the largest aircraft manufacturer in Europe, is incapable of producing enough commercial planes by itself to meet global demand, as is evidenced by its 10-year delay on orders. Brazil’s Embraer and China’s Cormac are still too small to produce at scale, and Japan decided not to enter the commercial plane business. It is therefore predictable that, at some point, taxpayers will bail out the company to free it from Calhoun’s debt. Let us make sure that when this happens, taxpayers get greater equity ownership than any institutional investor and can weigh in on decisions in order to prioritize passenger safety and an innovative industrial base over the share price. Liberate executive compensation from stock price, as was routine in Boeing’s heyday, so that the CEO of a corporation that produces planes with a 10-year design-to-sale timeline can focus on the long term. Limit the share of total stock held by any one entity to something lower than 5%, such as 2%. Put passenger advocates on Boeing’s board, alongside representatives of the engineering union and of the machinists’ union. Such changes would end the financial management of a manufacturing corporation, and that is what is necessary to prioritize safety and innovation. These commonsense changes would also likely increase long-term profits. Airbus, after all, is doing well with 25% government ownership and a workforce that is 100% unionized.

MARIE CHRISTINE DUGGAN holds a Ph.D. in economics and is professor of business management at Keene State College in New Hampshire.

Sources: Christian Davenport, “The life of two Boeing Starliner astronauts stuck indefinitely in space,” The Seattle Times, July 26, 2024 (seattletimes.com); Mike Wendling, “They went to space for eight days - and could be stuck until 2025,” BBC News, August 7, 2024 (bbc.com); Will Wixley, “Boeing lawsuit: seatbelt saved passenger sitting next to door plug blowout,” Fox 13, March 15, 2024 (fox13seattle.com); Joseph Rhee, Gerry Wagschal, and Jinsol Jung, “How Boeing 737 MAX’s flawed flight control system led to 2 crashes that killed 346,” ABC News, Nov. 27, 2020 (abcnews.go.com); SKYbrary, “B737 Series,” Accessed August 22, 2024 (skybrary.areo); airmech1776, “Designated overtime is killing my desire to be here,” r/boeing on reddit, Jan. 19, 2024 (reddit.com); Ed Pierson (edpierson.com); Don McIntosh, “Boeing Back in Bargaining—First Time in 16 Years,” Northwest Labor Press, March 14, 2024 (nwlaborpress.org); Dominic Gates, “Two key players in the Machinists’ Contract Drama,” The Seattle Times, Dec. 14, 2013 (seattletimes.com); Dominic Gates, “Boeing CEO’s compensation $29M, including $14M bonuses,” The Seattle Times, March 13, 2015 (seattletimes.com); Katya Schwenk, David Sirota, Lucy Dean Stockton, Joel Warner, “Boeing supplier ignored warnings of ‘excessive amount of defects,’ former employees allege,” The Lever, Jan. 8, 2024 (levernews.com); United States District Court, Southern District of New York, Hang Li vs. Spirit AeroSystems Holdings, amended class action complaint for violation of the federal securities laws, filed Dec. 19, 2023 (mustreadalaska.com); Dion Lefler, “Boeing and Spirit AeroSystems is a failed experiment that never should have happened,” The Wichita Eagle, July 2, 2024 (kansas.com); David Twiddy, “Onex to complete Boeing acquisition, deal still on despite union vote,” The Oklahoman, May 27, 2005 (oklahoman.com); Molly McMillin, “End of an era: Boeing in final stages of leaving Wichita,” The Wichita Eagle, August 8, 2014 (kansas.com); Kansas Department of Health and Environment, “Boeing Wichita Site,” Accessed August 22, 2024 (kdhe.ks.gov); CBC News, “Onex, Boeing named in class-action lawsuit,” CBC News, Dec. 20, 2005 (cbc.ca); The Seattle Times staff, “Rich Exit for Buyers of Boeing Spinoff,” The Seattle Times, August 16, 2024 (seattletimes.com); Dominic Gates, “Boeing whistleblower has waited a decade for change, now expects to leave,” The Seattle Times, June 2, 2024 (seattletimes.com); Dominic Gates, “Before Boeing CEO Hearing, Senate Releases New Claims of 737 MAX Fraud,” The Seattle Times, June 18, 2024 (seattletimes.com); “Written Testimony of Sam Salehpour,” Senate Committee on Homeland Security and Governmental Affairs, Permanent Subcommittee on Investigations, April 17, 2024 (hsgac.senate.gov); Dominic Gates and Lauren Rosenblatt, “Whistleblower Josh Dean of Boeing Supplier Spirit AeroSystems Has Died,” The Seattle Times, May 1, 2024 (seattletimes.com); Shawn Tully, “Exclusive: The Boeing Whistleblower testified for 12 hours before his suicide, here’s what he saw at the planemaker that alarmed him,” Fortune, April 24, 2024 (fortune.com); Shawn Tully, “The Last Days of the Boeing Whistleblower,” Fortune, March 16, 2024 (fortune.com); Jesus Mesa, “Boeing’s Dead Whistleblowers: Who Were Joshua Dean and John Barnett?,” Newsweek, July 9, 2024 (newsweek.com); “Staff Memorandum to Members of the Subcommittee: Preliminary Information from the Subcommittee’s Inquiry into Boeing’s Safety and Quality Practices,” United States Senate, Permanent Subcommittee on Investigations, June 17, 2024 (hsgac.senate.gov); Lauren Rosenblatt, “Machinists Pack T-Mobile Park in Show of Force Against Boeing,” The Seattle Times, July 17, 2024 (seattletimes.com); Lori Aratani, “Boeing’s largest union says it will strike if contract negotiations fail,” The Washington Post, July 17, 2024 (washingtonpost.com); Julie Johnson and Molly Smith, “Boeing rules out federal aid after raising $25 billion in bonds,” The Seattle Times, April 30, 2020 (seattletimes.com); Alex Halverson, “See how new Boeing CEO Kelly Ortberg’s CEO compares with WA’s best-paid CEOs,” The Seattle Times, August 8, 2024 (seattletimes.com); Yahoo! Finance, “NYSE-Nasdaq Real Time Price, The Boeing Company,” Accessed August 14, 2024 (finance.yahoo.com).