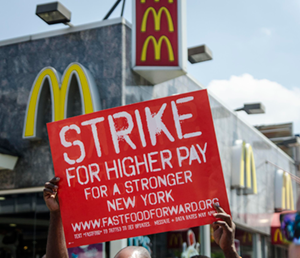

July 29, 2013 Protestor, by Annette Bernhardt. Licensed under CC BY-SA 2.0 via Wikimedia Commons.

Campaigns like 15Now and Fight for $15 are bucking convention and demanding minimum-wage hikes far larger than what has been past practice. Take, for example, the Fair Minimum Wage Act of 2007--one of the larger sets of increases in the federal minimum. This Act raised the federal wage floor by 40% in three steps: from $5.15 to $5.85 in 2007, $5.85 to $6.55 in 2008, and $6.55 to today's minimum of $7.25 in 2009. A $15 minimum wage, on the other hand, represents a more-than-100% increase in the federal minimum. The result? The fight for $15 has decisively changed the terms of today's minimum-wage debate.

The ball got rolling in 2013 with the breakthrough $15 minimum ordinance in SeaTac, a suburb of Seattle, Wash. Since then, some of the country's largest cities, including Los Angeles, San Francisco, and Seattle, have followed suit, passing their own citywide $15 minimums. In June 2015, Massachusetts passed a statewide measure covering Medicaid-funded homecare aides. Later in the fall, New York State passed a $15 minimum wage law for fast-food workers. This sea change seems to have occurred over just the past couple of years, dramatically pivoting away from President Obama's soft pitches to raise the federal minimum to $9.00 in 2013 and, more recently, to $10.10 in 2015.

These developments are certainly a remarkable political turnaround, but are these wage hikes economically feasible?

The immediate pushback against these campaigns has questioned whether it's feasible to expect businesses to adjust to a minimum-wage hike of this size without generating major negative unintended consequences. This opposition to a $15 minimum comes not only from expected corners--e.g., self-interested restaurant-industry lobbyists from the National Restaurant Association--but also from many economists. The most widely discussed of the possible unintended consequence is the large-scale loss of jobs. Such an outcome would counteract the primary intended consequence of a $15 minimum wage--to improve the living standards of low-wage workers and their families. The rationale is that, if you raise the price of anything, the quantity demanded of that thing will fall. This is how people usually interpret the basic economic principle known as the "law of demand." That raises a serious concern that raising the wages of low-wage workers will cause their employers to cut back on staff, leaving the workers worse off--either unemployed or working fewer shifts.

The current state of research on this employment question, however, finds that minimum-wage increases do not produce significant job losses. This then raises an important policy question: Why haven't there been significant job losses when minimum wages have increased?

First, the basic law of demand actually says something quite different and more specific than just "if the price of something goes up, the quantity demanded of that thing goes down." It actually says that if the price of something goes up--and nothing else changes--the quantity demanded of that something goes down. In the real world, however, other things are changing all the time. Moreover, raising the minimum wage itself causes businesses to change how they operate (more on this below). As a result, the minimum wage's actual impact on jobs depends on what other factors are changing at the same time.

Here's a specific, relevant example: Seattle's 2013 ordinance calls for a series of progressive increases in its minimum wage, up to $15 by 2021 for most businesses. At the same time that the city adopted this new policy, the local economy had been growing (and continues to grow) at a healthy clip. This helps explain why, according to the Puget Sound Business Journal, "six months after the first wage increase to $11 per hour took effect, the fear of soaring payrolls shows no signs of killing the appetite of ... the Seattle restaurant world--for rapid expansion." The title of the article sums it up: "Apocalypse Not: $15 and the Cuts that Never Came." Employment growth in Seattle's restaurant industry has not slowed.

The main point is that if no significant job losses result from minimum wages, then it must be the case that employers find other ways to adjust to their higher labor costs. And, in fact, past research has found that businesses often cover the costs of these higher wages by raising prices, re-directing some of their normal revenue growth into raises for their lowest paid workers, and finding savings from lower worker turnover, as higher wages strengthen workers' commitment to their jobs. A minimum-wage hike, in other words, causes both employers and workers to act differently from how they would act in the absence of a minimum wage hike. Employers adopt new strategies to increase revenue to support higher wages, and the stronger loyalty of better-paid employees frees up revenue that would have been spent on recruiting, hiring, and training new workers. Put another way, the "all else equal" clause simply does not hold in the real world. It's important to note, too, that there are disadvantages for employers if they cut their workforce--a smaller staff can make it hard for a business to maintain or improve its existing level of operation and also to retain or expand its customer base.

Even though past minimum-wage hikes have been more modest than the $15 minimum of today's political campaigns, we can use the existing body of research to develop a well- informed view of whether it's feasible for businesses to adjust to a $15 minimum wage without shedding jobs. This is exactly what my colleague Robert Pollin and I explored in our research earlier this year--we examined the question of whether the national economy could adjust to $15 minimum wage while avoiding any major negative unintended consequences.

Our analysis focuses specifically on the situation of the fast-food industry--the industry expected to require the largest adjustments. According to the U.S. Department of Labor, the two occupations that make up more than 62% of the jobs in the fast-food industry--fast-food cooks and combined food prep and serving workers--are the lowest paid occupations. Half of cooks earned less than $8.87 and half of combined food-prep and serving workers earned less than $8.85 in 2014. If fast-food firms can adjust to a $15 minimum without any major negative unintended consequences, other less-affected industries should be able to adopt a $15 minimum more easily.

In our study, we provide a detailed analysis of the labor-cost increase the fast-food industry would face as a result of a $15 minimum wage, taking as our starting point the situation as of 2013. We then use existing empirical research to make reasonable assumptions about the variety of ways firms could absorb these cost increases without shedding jobs.

We estimate that a $15 minimum, phased in over four years, would raise the overall business costs of the average fast-food restaurant by about 3.4% per year. About half of this cost increase could be covered through raising prices by 3% per year and assuming that quantity demanded will fall by about 1.5% due to the higher prices. This would mean, for example, that the average McDonald's outlet could cover about half of its total cost increase by raising the price of a Big Mac by $0.15 per year for four years--for example, from $4.80 to an eventual $5.40.

The fall in demand due to these price increases, however, is small enough that it can be more than offset by the rise in demand for fast food furnished by a healthy, expanding economy. Consumers tend to consume more fast food as their income grows. Over the past 15 years, industry sales have been growing at a slightly faster pace than the overall economy, or about 2.5% per year. As a result, even with the price increases, the fast-food industry should grow and add jobs, just at a somewhat slower pace. But note: this slower job growth is less concerning than one initially may think. Workers' gains in earnings per hour as a result of a $15 minimum wage--averaging 60% across the fast-food workforce--far outstrip the loss in earnings due to 1.5% fewer fast-food work hours added to the economy.

The remaining half of the cost increase could then be covered through cost savings due to lower turnover and by channeling more of the fast-food revenue growth generated by the growing U.S. economy toward payroll. We also found that, after these adjustments are made--increased prices, reduced worker turnover, and a more equitable distribution of the gains from growth--businesses will not have to cut into their profit rate at all. In other words, fast-food restaurants could adjust to a $15 minimum wage without laying off workers and without shrinking the industry's profit margin--the least desirable option from the perspective of employers.

There is one other possible outcome to consider: Will employers try to avoid higher labor costs, over the longer term, by replacing some workers with machines? So far, the empirical evidence of such capital-labor substitution suggests no. Preliminary research by Chicago Federal Reserve economist Daniel Aaronson and his colleague Brian Phelan indicates that jobs with a high level of routine manual work--the lion's share of low-wage positions in the fast-food industry--are unlikely to be replaced by technology in response to minimum wage hikes. This indicates that fast-food employers will tend to look first to other ways to adjust to a $15 minimum wage, before replacing their workers with robots. Since there are other ways for fast-food firms to adjust to a $15 minimum wage--as described above--it seems unlikely that employers would seek technological substitutes for their workers.

Businesses should, in other words, be able to adjust to a $15 minimum wage without having to shed jobs, as long as it is implemented at a reasonable pace. Such a policy, therefore, should provide major benefits for the lowest-paid workers in the United States.

Robert Pollin and Jeannette Wicks-Lim, “A $15 U.S. Minimum Wage: How the Fast Food Industry Could Adjust Without Shedding Jobs,” Political Economy Research Institute, Working Paper #373 (2015).