Fighting Climate Change in Portlandia

Not only is failure not an option, those fighting to avert cataclysmic climate change have achieved important successes worthy of celebrating.

Something remarkable has happened since the financial dramas of 2008-2009. A once-ignored, even deliberately marginalized school of thought within the discipline of monetary economics has moved steadily from obscurity to prominence. Its name recognition has grown to the point that its name--"Modern Money Theory" (a.k.a. "Modern Monetary Theory," or "MMT")--now likely rings more bells in lay public consciousness than does that of any other school of monetary thinking, perhaps even of macroeconomic thinking.

Exponents of MMT's take on monetary and macroeconomic phenomena now regularly appear at academic conferences and in policy debates. They figure frequently on television news programs and podcasts. One architect of MMT--Stephanie Kelton--even served as chief economist for the Democratic Minority Staff of the Senate Budget Committee in the years preceding the 2016 elections, and as chief economic advisor to Senator Bernie Sanders in his barnstorming bid for the Democratic presidential nomination.

Though I am not myself an MMT theorist, my approach to money, the financial system, and the macro-economy as a legal and financial theorist/practitioner is in broad sympathy with the MMT understanding of money and macroeconomics. And as it happens, MMT lends itself nicely to exposition by people with legal and practical financial knowledge. For unlike some "classical" approaches to monetary and financial subjects, its practitioners understand from the get-go our money's--and with it, finance's--deep roots in our laws and our institutions.

The best way to begin an exposition of what MMT is might be by reference to what it is not. MMT is prompted in part by a rectifying impulse. It aims to correct a mistake on which much of the classical macroeconomic and monetary theory of the past appears to have been founded. This is the error--in effect, the category error--of falsely assimilating resources to legal claims upon resources, and falsely assimilating sovereign units of political organization to units that buy and under the jurisdiction of such sovereigns. Conflating these things tends to generate cognitive mash-ups that vitiate theory and policy nostrum alike.

Insofar as MMT aims to correct the old orthodoxy's foundational errors, it operates as a kind of therapy. It cures macro and monetary economics of the vast tangle of conceptual contortions that have historically proceeded from its founding fallacies. How did past orthodoxy fall into its fallacies, exactly? In a word, "capital." There's a regrettable equivocation, we'll see, both in popular usage and in the use of the word by classical economists. Sometimes the word designates what would better be specified as "physical capital," or what I'll call "resources." Other times it designates what would better be specified as "financial capital," or what I'll call "claims upon resources."

It's easiest to trace the procession of errors that stem from the "capital" conflation by walking through a just-so story that many people seem to take for foundational. In this story, there are "two kinds of people in this world." On the one hand are "surplus units"--people who've saved money or accumulated resources over time. On the other hand are "deficit units"--people who have need of saved money or accumulated surplus but don't have it. Financial institutions and markets, we are then told, spring up as "middle men" to enable these units to find one another. They broker contracts between parties for the use of "scarce capital" at a price--be that price interest, equity appreciation, or some other form of compensation. I call this "the intermediated scarce private capital myth."

Now among the "deficit units" in our story is something that classical orthodoxy calls "the government." ("The government" here is already being assimilated to nongovernmental entities--other "deficit units.") Government "doesn't produce anything," in the classical story, nor can it sell equity stakes in itself (we hope). So it has nothing to sell to earn money. It therefore has only two means of funding its operations. It must either borrow or "take" from the surplus units--the latter in that form of taking we know as taxation.

But this means, on the classical account, that limits on public finance take a very specific form. If the government borrows too much, we are told, it will grow less credit-worthy, will "crowd out" private producers who also need access to scarce private capital, or both. And if the government taxes too much, then it will again crowd out private investment, and might now be ousted by angry citizens who launch "tax revolts." Either way then, "government" is at the mercy of "surplus units" who have accumulated "scarce capital" that the government needs to operate, and that they can charge rents for, refuse to hand over, or both if the government gets uppity.

It's not hard to see how this picture might prompt certain policy admonitions we hear all the time. References to "skittish capital" and "bond vigilantes," particularly in connection with alleged government "over-spending," channel the myth. So do complaints about taxes, and assurances by deep thinkers like George Bush and Grover Norquist that "it's your money" when they demand "tax relief." And so, of course, do cries that we're "burdening our grandchildren with debt," or that "the government will go broke," or that the Fed, as that other deep thinker, Sarah Palin, once charged, is "debasing the currency" when it accommodates fiscal expansion by purchasing Treasury bonds in open-market monetary operations.

But all of this is a howler--a very, very crude error. And it's so because the foundational equivocation and foundational pictures upon which it rests--the equivocation on "capital" and the intermediated scarce private capital myth--are themselves erroneous.

To see why the intermediated scarce private capital myth is mere myth, and how it trades on equivocation on the word "capital," we must attain clarity about the relations among resources, claims upon resources, and credit. Once we do, we'll see that the classical economists' conflation of sovereign political units with families and firms corresponds to its conflation of resources with claims upon resources--and to a false separation of credit and money.

Let's begin with a family or firm that takes part in an exchange economy. Adult family members purchase homes, vehicles, education, and so on. They sell services of various kinds--often all lumped together as "labor"--to earn what is needed to purchase these things. Firms act in similar fashion. They purchase "inputs" to what they produce, and use the proceeds of sales of what they produce both to pay for those inputs and to yield whatever surplus above inputs--profits--their owners are seeking.

Now in most of these cases, households and firms engage in exchange via some medium of exchange. This medium is often called "money." Insofar as money functions as a medium of exchange, it can be thought of as a claim upon what it's exchanged for. Its status as legal tender makes it a legal claim upon what it buys--a claim upon resources. But money is more than a present-moment claim, more than a medium of immediate exchange. It also works as an inter-temporal claim, a medium of exchange between present and future. Here is the source of economists' familiar observation that money is not only a medium of exchange, but also a "store of value."

Money's "value" component stems from its status as a claim. Its "storage" component stems from its status as a claim operative through time. What classical economists historically overlooked is that the inter-temporal aspect of money--money's very capacity to serve as a store of value--is rooted in its relation to credit, that all-important phenomenon named by an English word stemming from the Latin word credere ("to believe"). Money bridges time because credit bridges time--the "belief" involved in extensions of credit is belief in the future, belief that the one who is credited will live up to her obligations.

Let's see more precisely how this works. Often a household or firm does not yet possess enough money to purchase what it must for its purposes. And often it's not possible to earn such money without first selling something that one needs money in order to make or supply in the first place. (Hence the old adage, "it takes money to make money.") I might have to purchase a car, for example, in order to take a new high-paying job far from home. But I also might lack the money to purchase the car until I have already worked at the job for a while and been paid.

That puts me in a bit of a bind. I already have, in a sense, the capacity to earn the money to pay for the car--I have the job offer--but I can't begin earning that money till I have the car. This is in a certain sense "tragic," in the classical Greek sense of that word. I have capacity, yet something is blocking my exercising that capacity. But if I am not "capacity-constrained," then what is the something constraining me?

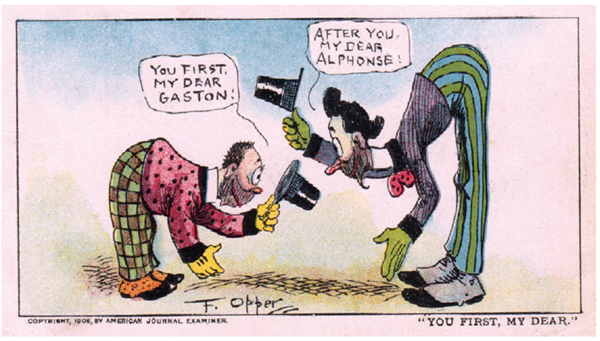

Frederick Burr Opper's Alphonse and Gaston, an early American comic strip featuring a bumbling pair from France.

Source: American Journal Examiner, 1906, via Wikimedia Commons (public domain).

My starting the job and my buying the car in this story are a bit like those men at the doorway who keep saying "after you." The two men--the old comic strip characters Alphonse and Gaston--never pass through the doorway even though each has the capacity to walk through the door. What constrains them? What we might call the structure of their social relation--in this case, the fact that each feels compelled to wait for the other to walk through the door before himself walking through the door--acts as an institutional obstacle to their moving at all. It is their convention--their "after you" convention--that blocks their way. And the same holds for firms as for families, for firms typically need money to buy what they use to produce what they sell for money.

We're faced with a situation, then, in which there is no basic capacity-constraint, no salient resource-constraint, but a significant institutional constraint.

Now, most societies with exchange economies develop institutions to deal with this Alphonse/Gaston problem. In many societies we call these "financial" institutions, among which banks in particular are prominent. These institutions alter the structure of the "social relation," as I called it, between Alphonse and Gaston. They enable more exchange to take place across space by enabling exchange across time. And in so doing, they make possible more productive activity across time. (Here is the source of what some heterodox economists, including John Maynard Keynes, have called "the monetary theory of production.") They do this by allowing us in a certain sense to spend now what we won't actually have until later. They allow, in other words, "advances" now on what is expected to be "realized" later, especially when such advances are prerequisite to that later realization--that production--itself.

Now none of this would be possible unless resources and control over resources--claims upon resources--were two different things. What are inter-temporally exchanged via the institutions I've just described are not material capacities or resources themselves, but claims upon such capacities and resources. That's what the money you borrow amounts to--a claim upon current resources that you can then use to produce more future resources. And while material capacities or resources must of course be pre-accumulated to be used, claims upon such resources need not be pre-accumulated. They can be what I'll call "generated," in ways we shall presently come to.

All right, I've said a bit about money in talking of credit, of capital, and of resources and claims upon resources. Now let us focus on money specifically in relation to credit. Money, it turns out, is not simply associated with credit. In an important sense, money is credit. (Hence the compound word used by some heterodox economists, "credit-money.") Its being a kind of circulating credit is part of what enables money to function as an inter-temporal claim--a "store of value"--in the first place.

How can that be? To begin to appreciate how, take out a dollar or five dollar or ten dollar or ... bill from your pocket. If you don't have one on you, pull up an image on your mobile phone or other device. Now if you read across the top, you'll see the inscription, "Federal Reserve Note." What do you suppose "Note" means here? Is it a "mental note" or a missive? No, it's what lawyers will recognize at once as a promissory note.

A promissory note represents a legally enforceable commitment--a contractual promise. The promisor undertakes to do something in future. (You don't have to promise if you're doing it now.) The promisee undertakes to trust the promisor--to believe her when she says she will do what she's promised to do. Insofar as the promisee does so, he "credits" the promisor with whatever he puts at risk of the promisor's possibly breaching the promise. In so doing, the promisee becomes a creditor, the promisor a debtor. The creditor holds an asset, the debtor owes a liability. The promissory note signifies both--it represents the issuer's liability and the holder's asset.

Perhaps needless to say, promissory notes in scenarios like this one function as means of payment. I need something from you now, I offer something in the future, I "pay" you the promissory note now as a token--as proof--of my promise to perform in the future. My promissory note is thus functioning as a medium of exchange. That's one thing, recall, that all economists tell us that money is.

But now what is the Fed promising? And thus how can its promissory notes function as modes of payment--as currency or "paper money"?

The great heterodox economist Hyman Minsky, who learned much from Keynes and from whom many MMT advocates and other economists have learned, once memorably said anyone can issue a currency, while the trick is to get it accepted. In a sense, what Minsky was saying was that private promissory notes can serve as methods of payment from one party to other parties who know and trust her, and in that sense function as "private moneys," but are unlikely to be accepted in payment by parties who don't know or trust her, hence cannot function as public moneys. If something is to circulate widely as a mode of payment, then, it must be a sort of promissory note everyone recognizes and trusts, that everyone will accept in payment as a form of money. That note in the U.S. is the Fed note, and in any other jurisdiction is that jurisdiction's own central bank or monetary authority's notes.

When you borrow money, then--which you do by handing a bank your own promissory note in exchange for Fed promissory notes (or for a check or deposit denominated in note units)--you just temporarily swap your notes for Fed notes. You transform narrowly accepted notes into widely accepted notes, private money into public money. But this just means you trade evidence of your own promise for evidence of Fed promises. It's still all about promises--hence about credit and debt, asset and liability--you see. All that varies is whose credit, whose debt--whose asset, whose liability.

One way of thinking of private banking institutions, against this backdrop, is as outsourced credit-checking offices of the Fed and, in consequence, of Us ('We, the People')--all Americans, whose central bank the Fed is. I call this a franchise arrangement--a "finance franchise"--in which we the public, acting through our Fed, are the franchisor and private banking institutions, which dispense the monetized full faith and credit of the United States, are the licensed franchisees.

Private lending banks, which in theory have better access to information about the credit- worthiness of those who live near them, do the credit-checking for us and our Fed. In so doing, they decide whose private promissory notes will be temporarily tradable for the public promissory notes--the Fed notes--that banks dispense. They thereby help the Fed turn private money into public money. And in so doing they provide credit in a form that, by being "cashed out" in widely accepted claims upon resources--i.e., as money--enables the wide use of current resources to produce future resources. In other words, they finance--or at any rate are meant to finance--productive activity.

All right, there's the relation between credit (as trusted promise) and money, and between private note-money and public note-money. But I still haven't said what the Fed's promising, exactly. Nor have I said what this all has to do with the intermediated scarce private capital myth mentioned above. What about those? The best way to finish our story, I think, is by reference to a bit of apparently forgotten history.

There was a very brief while during which Federal Reserve notes were "backed up" by gold--or at any rate were redeemable by some people for such. They could in this sense be thought of as something like "claim checks" on gold. Some view this fact--which was true for only a very brief span of the Fed's 105 year history--as indicating that inscriptions like "Federal Reserve Note" now are vestigial, a bit like the human tailbone. But that is a mistake.

What people who make this mistake fail to grasp is that gold itself was like paper when it first came to be used as a medium of exchange. Gold itself, in other words, is no more "inherently" monetary than paper. The true story goes roughly like this...

In the ancient Near East, early civilizations were heavily dependent on agriculture. Because crop yields were subject to mercurial nature, it became common practice to store grain during fat years to provide for lean years. Grain storage of this sort, vital as it was, was not left to the wisdom of individuals alone. It was a state function, much as old age insurance in the form of Social Security is today. Growers were required to make "grain deposits" into a community pool, the requirement operating as a kind of countercyclical tax or mandatory social insurance premium--again, somewhat like Social Security taxes today.

Now when you "deposited" your grain per this requirement--generally with a priestly authority, since state, religion, and the means of sustenance were closely bound up in those days--the authority who received your deposit gave you a token or "receipt" which indicated that you had made your required deposit. The tokens in this case were a bit like the stamp that is inked to the back of your hand when you go to a club--they showed you had "paid."

In time, these tokens began circulating as currencies. It is not hard to see why. Suppose that your neighbor has land that yields good, "bumper crops." Suppose that your land is more barren, but that you're a good toolmaker. In such case there are gains to be had from letting your neighbor "deposit" extra grain at the grain-store, collect extra receipts for having done so, and then give you those extra receipts in return for your making her tools. That way you both get to do what you're best at, and so both of you are able both to produce more in aggregate and to prove that your grain obligation is satisfied.

Now implicit in the practice of giving a receipt for the grain deposit is a commitment by the grain-gathering authority to recognize receipts as verification that required grain deposit have been made. We can think of this as a term in a sort of social contract pursuant to which members of a society (or their deity) undertake to recognize the authority of a governmental agent (or priest) to requisition grain during fat years for provisioning during lean years, while that authority undertakes to recognize her own grain receipts as proof positive that grain depository obligations have been met. In this sense the receipts function as assets of their recipients, and as liabilities of their issuers.

Now note how once this commitment is in place, the "receipt" will acquire the characteristics of a claim. It is a claim to the authority's recognizing the receipt-bearer as one who has already "paid his taxes" or as good as paid his taxes. And, once those lean years commence, it is a claim to some grain from the grain store as well. Once tax receipts become "vertical claim checks" as against the taxing authority in this sense, it is only a matter of time before they begin circulating as "horizontal claims" too among those who need them for "vertical" purposes--just as they did in the story of you and your grain-growing neighbor above. All people need them, and so all people accept them in payment of all manner of thing--not only grain now, but also tools and much else. These are public liabilities that function and circulate as private assets, so everyone uses and accepts them.

You can see here in nucleo, then, the sense in which Federal Reserve notes might function as claims on or liabilities of the federal government even as they circulate as claims or as assets among citizens.

Think of the Treasury Department as the grain-gathering authority, and of the Fed as the claim check issuing authority. These are two organs of one government--our government. And the one organ recognizes--we recognize--only the receipts issued by the other in payment of taxes.

But now what about gold? How did that ever come into the picture? And why did the Fed ever have anything to do with it?

The important thing about claim checks was never their material form, but the fact that they reliably represented claims. Receipts of this kind actually took many different material forms over time. In the ancient Near East, clay tokens stamped with the grain authority's seal were a convenient form. (That seal was the progenitor of the later "Federal Reserve Note" inscription.) Later, as civilization advanced through the Mediterranean region, Anatolia, Persia, India, China, and beyond, new material representations of the same kind of claim came along.

One material form that became widespread for a time was the so-called "precious metal" coin. It is of course commonplace nowadays to think of metals like gold, silver, platinum and others as somehow inherently precious, and thus "natural" stores of monetary value. But the truth seems to be the reverse--these metals became precious largely because they came to be used widely as material representations of money claims.

Why would that have happened? The answer seems to be that the comparative softness and malleability of these metals, combined with their resistance to corrosion, made them easy to stamp durable official images and code words upon. If, for example, it was now Tarquin or Caesar in Rome, rather than the Pharaoh or High Priest in Egypt, who was requisitioning taxes from the citizenry, and if the climate was not dry enough to rely upon clay tokens not to disintegrate, it was natural to seek some more lasting substance into which the sovereign's image could be stamped when it came to issuing sovereign receipts to the taxpayers. Precious metals were just the ticket--the perfect "payment ticket."

Precious-metal coins thus became dominant money-forms throughout the ancient world. This continued into the medieval period, with only the taxers and issuers--monarchs, feudal lords, etc.--and their images changing. As cities with increasingly differentiated economies began growing at the margins of feudal manors, however, coins and big blocks of metal called "bullion" became increasingly inconvenient as money forms. For one thing, they were heavy--and this problem grew worse during times of inflation, when more metal was needed for the same purchasing power. For another thing, lugging metal signaled to brigands that you were fat prey. So people began "depositing" their metals with metalsmiths, who had "safes," for safe-keeping. The smiths for their part issued paper claim checks--or "notes"--representing claims on deposited metals.

Once such "claim check" issuance spread, it didn't take long for people to discover that using the paper in payment, rather than going back to get gold and then carrying it to transaction sites, could save time and effort. It also didn't take long for the metalsmiths to discover a new opportunity their claim checks afforded: once their claim checks began circulating as paper currency, they could issue such checks to themselves at no cost and then buy things. They also could issue them for lending at interest. As long as the checks were not issued too far in excess of the coins and bullion in store, there was no danger in doing this, and there was much to be gained.

In time this line of work unsurprisingly grew much more lucrative than metalsmithing. The benches on which metalsmiths did their smithing--or "banca," as benches are called in Italy where this practice developed--gave their name to what we now call "banking," not metalsmithing. And the practice of issuing more notes than one had coins and bullion became known as "fractional reserve banking." The metal money tokens were a "reserve," which represented a mere fraction of total note issuance.

Now this practice of issuing more notes than they had coins made banking not only profitable, but also both socially useful and risky. It was profitable because note-issuers got something for nothing--they received "seignorage," so-called because the first issuers who enjoyed this privilege were monarchs or manorial lords (Old French, seignors) themselves. It was socially useful because it allowed for what later came to be called an "elastic currency"--a currency whose supply could be grown both to accommodate growing transaction activity and to finance growing productive activity. (Recall our Alphonse and Gaston story above.) And it was risky--both for the banker and for society--because the elastic currency could be "over-stretched," issued too far in excess of the metal that "backed" it.

Much of bank regulation, in consequence of these facts, took the form of reserve-regulation in olden days. But there was no inherent necessity for required reserves to be metals. The only reason they were in the early days was because such metals themselves were stamped by the sovereign as "legal tender," good for the discharge of "all obligations public and private." In other words, just as the paper memorialized promises, so did the metal. The only difference was that the paper memorialized private bank promises, while the metal memorialized public authorities' promises (which of course generally were "worth" more thanks to the power of sovereigns).

In time, public authorities began memorializing their promises with paper as well--with both sovereign bonds and sovereign currencies. Gold was used mainly for cross-border transactions--i.e., transactions across jurisdictions and thus subject to no single currency-issuing jurisdiction--for much of the 17th, 18th, and early 19th centuries. Periodically, and especially in the mid-19th century, some jurisdictions would reintroduce gold as "reserve money" in order to signal to their populations and one another that they would not over-issue currency, as sometimes happened during rough patches like revolutions and wars. The U.S. Fed was established during this later period, and so for a brief while it shared in "the gold standard" with other nations' central banks.

But not long after the Fed's founding, the Bank of England abandoned metallic standards, and the Fed followed shortly thereafter. Since then, private bank "reserves" at the Fed are generated much as individuals' "deposits" are generated by private banks themselves--viz., by the former's simply crediting or opening an account for the latter. There is no metal constraint at all. The only "natural" constraint on the private bank is what loans can be made profitably; and the only "natural" constraint on the central bank--the Fed--is essentially the same: it is how much credit-money can be privately generated and publicly accommodated as Fed-recognized loans before the credit-money supply's growth rate grows too rapid for "real," materially productive growth to keep pace and avoid inflation.

This latter is a key point for MMT advocates, and is its answer to "gold bugs," to classical economists, and in effect to the intermediated scarce private capital myth itself. There is no "natural" limit on how much credit can be generated, hence how much money can be issued. Even required reserve ratios calculated in relation to gold were not "natural," since the ratio itself could always be changed "by fiat." (Gold bug complaints about "fiat money" are in that sense red herrings.) The gold standard itself, in other words, just like the first sovereign gold coin, was a sovereign promise. The only "natural" limit on credit-money issuance, then, is in a certain sense ... nature itself.

MMT advocates call this the "resource constraint." But what they mean by "resource" here isn't just natural resources like land, water, air, etc. They mean aggregate material resources, produced and unproduced, including what can realistically be produced over a given time interval. The credit-money supply must be able to grow at a rate that allows for this resource stock to grow through the productive activity of those who need claims upon current such resources--i.e., money--in order to produce future resources. There must be enough money, in other words--enough circulating resource-claims--to accommodate people like me in my car and job story above.

It is possible, of course, for there to be less than this optimal quantum of money in circulation. That again was the story of my car and job, pre-finance Alphonse and Gaston story. But it is also possible for there to be more than this optimal money supply. If those promises that are money proliferate more rapidly than our aggregate capacity actually to fulfill them through real productive activity, then we will have over-promised, over-committed. We will have issued more promissory notes than can realistically be redeemed.

In such case the promises will lose value, possibly becoming worth less, as the old adage has it, "than the paper they're printed on." This is of course what we call "inflation." And it is the real constraint upon sovereign spending and "borrowing." This, not the gold supply or even the current (as distinguished from the current-plus-feasible-near-future) resource supply, is the only relevant scarcity where money-issuance is concerned. And this is because financial capital (claims upon resources), unlike physical capital (resources), is not "scarce" or "intermediated," but generated by the Fed, the banking system through which it works, and the Treasury.

What, then, do bond issuances and taxes do, if they do not "fund" the government as orthodoxy has it? Easy: Selling bonds and levying taxes takes privately held money out of circulation. Often it's helpful to do this when our government is itself spending, because if we don't there's a risk of inflation. But sometimes there's also no need to do this--e.g., during a downturn or debt-deflation, when not inflation, but its opposite is the salient danger. In such cases public spending supplements inadequate private spending, and need not be "funded"--i.e., accompanied by contractionary measures like taxing and bond-selling--at all.

Any tax lawyer will tell you that this is what the Internal Revenue Code is for--it's for altering the volume and/or the allocation of money flows, not for "raising money." And anyone at the New York Fed trading desk, who buys or sells Treasuries every morning in pursuit of Fed "open-market operations," will tell you that Treasury securities are for providing the markets with "safe assets" and for buying and selling to alter the money supply, not for "borrowing money." It's a shame that so many classical economists, who evidently needn't know how the actual tax code and bond markets work, have historically not listened to those lawyers and traders.

We can now see, in any event, the error of classical orthodoxy in bold relief. It is wrong to conflate resources with claims upon resources, because claims can be generated in excess of current resources as long as doing so prompts the production of additional resources. It is wrong to conflate sovereigns with households and firms, because sovereigns can issue claims upon everything--public money--while households and firms can issue claims only upon themselves--private money--which won't be "accepted" by others until successfully swapped for those ever-sought claims on the sovereign that we call money. And it is wrong to believe all capital is "scarce, private, and intermediated," because this too is to conflate resources with claims upon resources--and to forget moneys are claims to performance of promises--under the single equivocal word "capital."

Once we see all of this, we see that classical orthodoxy was and is superstition. It was and is mythology, rooted in distant spells cast by "divine emperor"-stamped shiny metals, traditions that treat debts as sins (some languages actually use the same word for both), and mystical conflations of signs with things signified. Currency and coin are not money; they represent money. Debt is not sin, it is worthiness of credit--credibility. And metals are neither inherently precious nor "basic." Believed, publicly endorsed promises are the basis of money--they are what banks give you public money for. This is what MMT and its allies want you to see. All you need do is to open your eyes.