Investment in real inputs--structures and machinery used to boost future output and productivity--is one of the ways that an economy grows over time. In a capitalist economy, such investments are also crucial for macroeconomic stability and full employment because they provide an "injection" of demand to balance the "leakage" caused by personal and institutional savings. The Great Recession that began in 2007 was marked by a collapse of investment unprecedented since the Great Depression, as well as a dramatic drop in overall production and a sharp jump in unemployment. Since 2009, overall output has been growing again, but we have seen a much slower recovery of investment than after other recessions since 1947. The worst economic crisis since the 1930s, the Great Recession came after a long period of declining investment, and a break in the linkage between corporate profits and new investment.

July/August 2013 issue.

Rising Profits, Falling Investment: The share of national income going to investment (net of depreciation of existing plant and machinery) has been declining since the beginning of the "neoliberal" era, around 1980. Since the start of the Great Recession, net investment as a share of GDP has plummeted to its lowest level since the 1930s. This sharp drop in investment comes despite sharply rising profits.

Monetary Policy Isn't Working: The Federal Reserve has helped to shorten past recessions by driving down interest rates to lower the cost of borrowing and so spur investment. During the current crisis, the Fed has conducted an aggressive monetary policy, raising the money supply to lower interest rates. But it has had little effect on investment. While lower interest rates have had only a weak effect on investment in the past, monetary policy has had no discernible effect in the last few years, as investment rates are dramatically lower than would have been expected given the level of interest rates. Substantial excess capacity, weak expectations of future sales, and corporate strategies to shift production outside the United States all may be contributing to the lack of investment demand.

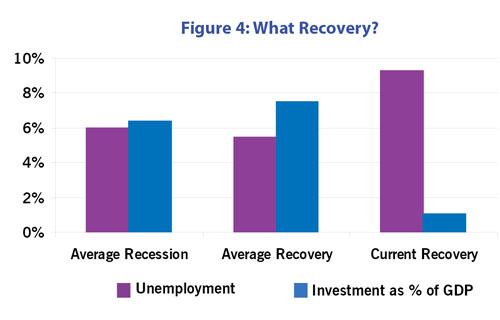

Low Investment Impedes Recovery: In one respect, the current recession resembles past experience. Low rates of investment are associated with high rates of unemployment, just as in previous economic downturns. The difference is that, three years after the official end of the Great Recession, the unemployment rate remains persistently high, and investment remains dramatically lower than in past recoveries.

We Are Still Far from Recovering: During the current "recovery" (2009-present), the unemployment rate has remained higher and investment as a share of GDP has remained lower than the average not only for past recoveries, but even for past recessions (since 1947). No wonder the current situation seems more like a continuation of the Great Recession than a genuine recovery.

The Broken Link between Profit and Investment: In the past, higher corporate profits were associated with higher rates of investment, as businesses have rushed to take advantage of profitable opportunities. In the current crisis, however, the link between profit and investment has been broken and investment rates have been very low despite high rates of profitability (especially in 2010 and 2011). Businesses are holding back on investing, either because they anticipate continued low levels of demand (perhaps due to high unemployment and low wages) or because they plan to shift more production outside the United States.